How to Write Off Your Vehicle Deduction as a Self Employed Business Owner

Wanna turn your sweet ride into a sweeter write-off? In this blog, we’ll be covering step-by-step how to turn your vehicle into a legitimate business deduction. Let’s kick this thing in into gear!

DISCLAIMER: The content provided is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Always consult with a professional.

Step #1 - Rack up some business miles on your vehicle

Let’s set the record straight: your automobile does NOT have to be under your business’ name to claim the business deduction. In fact, many (if not, most) small business owners take the deduction with a personal vehicle.

What really matters is that you’re using the vehicle at least partly for business. For the deduction, business miles can include things like:

- Going to meet a client, vendor, or other business contact

- Driving from one business location to another (including job sites)

- Business supply and errand runs

- Business banking

The more you drive your vehicle for business during the year, the higher your deduction will be.

Business miles do NOT include any drives to or from your home, even if for business purposes. These are instead referred to as commuting miles, which are non-business.

The exception: if your home meets the definition of your principal place of business, then any business rides to/from your home can be counted as business miles.

Step #2 - Keep track of mileage

If you want your deduction to be on the up-and-up, you must (emphasis on MUST) keep track of your business miles. You should keep some sort of mileage log where you record all the drives you make for business.

There are several apps that allow you to log your mileage. A few popular ones are:

- Quickbooks Online mobile app (if you have subscription)

- MileIQ

- Everlance

- Hurdlr

You can also use something like a spreadsheet to log your trips.

For each business drive, you should at least note down the following info in your log:

- the date

- your starting point

- your destination

- total miles driven

- business purpose

You also need to make sure you’re keeping your log updated throughout the year. It’s a requirement for taking the deduction. But even if it wasn’t, it actually benefits you to keep your log up-to-date.

Think about it. The longer you take to log a business drive, the more likely you are to forget that drive even happened. Then it never gets logged. And when business trips fall through the cracks, your deduction shrinks. That’s why you want to log your business trips right away.

Best practice would be to record business trips into your log the day of. But at least once a week, catch up on logging the straggles that you didn’t get a chance to record that week.

In addition to business miles, you also need to keep track of the total miles you drove your automobile each tax year. The easiest way to do that is to note (better yet, snap a pic of) the odometer reading that the end/beginning of each tax year and calculate the difference.

“Maximize Your Biz Tax Deductions” is an on-demand course to help you:

- Get to know the top business deductions available to you as a self-employed biz owner

- Take the steps to maximize your tax saving potential & slash your tax bill

- Avoid the biggest tax pitfalls to steer clear of tax trouble and unnecessary penalties

(Psst! it’s also a biz tax write off 🤫)

Step #3 - Decide which method to use to calculate your vehicle deduction

There are 2 ways the IRS allows self-employed business owners to calculate their deduction: the standard mileage method and the actual method.

Standard Mileage Method

The standard mileage method is definitely the easier of the two calculation methods. The deduction is your total business miles driven during the year multiplied by the standard mileage rate set by the IRS for that year. The mileage rate for each tax year can usually be found with a simple online search.

Since the rate is already set, you technically wouldn’t need to keep track of your automobile operating expenses (at least not for the deduction). However, you still need to be all over that mileage log like white on rice.

Actual Method

With the actual method, you can deduct the business use percentage (business miles / total miles) of all of the automobile expenses you paid for during the year, including:

- Gas

- Repairs

- Maintenance

- Insurance

- Tires

- License plates

- Registration fees

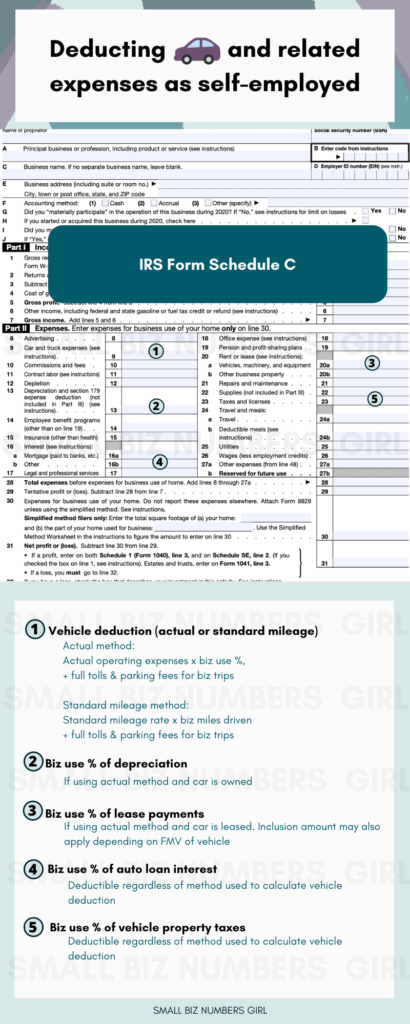

If you use the actual method, you can also separately deduct the business use percentage of the depreciation (if owned) or lease payments (if leased) of your automobile. These amounts are not included in the vehicle deduction itself, but instead added to their appropriate deduction categories on your tax return (“Depreciation” and “Rent or lease”).

Lease payment deductions are subject to inclusion amounts. If the fair market value of the car you lease is over a certain amount, you will have to decrease your deduction by the business use percentage of the applicable inclusion amount. The inclusion amount varies by lease period and fair market value. To determine your inclusion amount, if any, look at the appendices in Publication 463.

When using the actual method, you must keep track of all of your vehicle expenses during the year. If the vehicle is under your name personally, then it is good practice pay for and track these expenses separately from your actual business expenses (especially if your business is an LLC). Although you’re allowed a deduction for your business use of your own vehicle, the expenses are still personal for all other purposes. They shouldn’t be treated like regular business expenses.

You can use an app or a spreadsheet for keeping track of your vehicle expenses. And don’t forget to store your receipts.

Need something to help you organize your personal automobile expenses, and quickly compare your deduction between methods? Check out this Excel vehicle expense tracker worksheet.

Expenses you can deduct under both methods

Under both the standard mileage and the actual method, you can add to your vehicle deduction amounts paid during the year for:

- Full parking fees for business trips

- Full tolls paid for business trips

You can also separately deduct amounts paid during the year for:

- Business use percentage of vehicle loan interest (as Interest expense)

- Business use percentage of value-based vehicle taxes (as Taxes and Licenses)

Be sure to keep good records of these expenses as well, regardless of what method you’re using.

Which method is best? To put it in an accountant’s favorite answer: it depends. Everyone’s situation is different. However, generally, the actual method tends to work best for those with a large amount of vehicle expenses (including the cost of the automobile itself), while the standard mileage method benefits those who drive a lot of miles for business.

A couple things to keep in mind:

- If you own the vehicle, and you use the actual method your first year, you must use it in all future years for that vehicle.

- If you lease the vehicle, whatever method you use the first year is the same method you must use for future years for that vehicle.

It might be beneficial compare your deduction between the two methods to see which method will likely work best for you in the long-term.

Step #4 - Report Your Deduction

As a self-employed business owner, you’ll report the vehicle deduction, as well as all the related deductions (e.g, depreciation, lease, vehicle interest, vehicle taxes) on IRS form Schedule C.

Now, 10/10 would recommend you get your return filed professionally, or at least using tax software if DIY’ing. That way you don’t have to put too much time and effort calculating deductible amounts and figuring out what goes where.

With that said, when you review your Schedule C, your deductible vehicle expenses will be reported something like this:

If you own your vehicle and using the actual method, also complete IRS form 4562 to calculate the depreciation of your vehicle. Again, it’s recommended that your return gets filed using tax software so the necessary forms are automatically included.

Now you have all the steps to help you writing off your vehicle with confidence. So start tracking all your business miles and vehicle expenses, and get to deducting!

“Maximize Your Biz Tax Deductions” is an on-demand course to help you:

- Get to know the top business deductions available to you as a self-employed biz owner

- Take the steps to maximize your tax saving potential & slash your tax bill

- Avoid the biggest tax pitfalls to steer clear of tax trouble and unnecessary penalties

(Psst! it’s also a biz tax write off 🤫)