The Self-Employed Business Owner's Guide to the Home Office Deduction

If you’re a business owner, you just might be living in tax savings…literally.

Maybe you’re operating entirely out of your house. Or maybe you just perform certain business tasks in the comforts of home. In either case, you may be entitled to take the “home office” deduction, which allows business owners to write off a portion of their home expenses. And that can add up to some major moolah in tax savings.

It’s no wonder that over the years, I’ve received quite a bit of questions about the deduction from fellow business owners. Here, I’m sharing the answers to the most common questions, and what you need to know to to taking this write-off yourself as a self employed business owner.

DISCLAIMER: The content provided is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Always consult with a professional.

What is a "home office"?

You might have heard it call the “home office” deduction. I even refer to it that way myself. But the truth is, you don’t need an actual “home office”; no walls are required to take the deduction.

All you need is a clearly separate space that you use only for your business, and that workspace can count as your “home office”. You also don’t need to own the home you do business in; a place you rent works just as well.

How do I qualify for the deduction?

First, you must be able to pass these two tests:

Test #1: Regular use – Do you have to be using your workspace all the time? No. Sometimes you need a change of scenery every now and them. Or perhaps you also have an actual business location outside your home. That’s totally fine. As long as you’re using your home workspace on a regular and continual basis to do actual business activities. Not just to take a rando business call or as a dump station for all your business junk.

Test #2 Exclusive Use – That means everything you do in your workspace must relate to your business. So for example, it can’t be a home office by day and a lounging area by night. Also, emphasis on YOUR business. You shouldn’t be using the workspace to do any work as an employee for an outside job.

CALLING ALL PHYSICAL PRODUCT SELLERS!

If you use the space in your home to regularly store inventory, the exclusive test is automatically considered “passed”.

Note: Having another location outside your home does not necessarily disqualify your home being a principal place of business. For example, you may have a space outside your home that you mostly perform non-administrative/managerial activities; you might still choose to designate your home office as the hub for performing the admin/managerial stuff.

If you can pass those 2 tests, then your next step is to make sure your workspace falls in one of these 3 categories:

1. Principal place of business – your home office is your principal place of business if this is where do most of your admin and management activities for the business (e.g., billing, ordering, scheduling, bookkeeping, etc.), and there’s no other place you perform a lot of these tasks.

2. Meeting place with clients, patients, and customers – a place where regularly meet clients, patients, or customers (this qualifies even if you also have another office outside of the home where you meet them). However, occasional meetings or telephone calls don’t count.

3. Separate structure –a separate, free-standing structure of the home (e.g., standalone garage, studio).

Once you can check off all these boxes, you can start deducting your home expenses.

How do I calculate the home office deduction?

As a self-employed business owner, you have two ways you can calculate your deduction: the actual method and the simplified method. Whichever method you’re using, your deduction is typically limited to your taxable business profit for the year.

Psst: If you’re looking for a simple way for tracking expenses to maximize your deduction, check out this Excel home office deduction calculator spreadsheet.

Actual Method

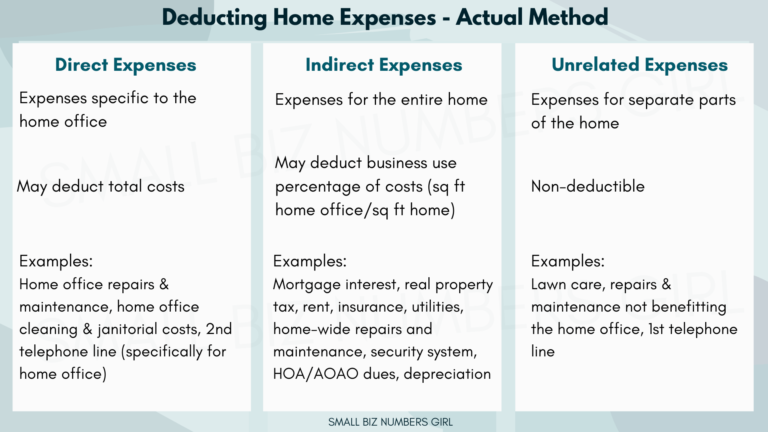

Under the actual method, you’ll calculate your deduction based your actual home expenses. For the deduction, your deductible home expenses will fall into one of 2 groups:

Direct expenses

Direct expenses are expenses that are specifically incurred for the home office. These costs are fully deductible. Examples include:

- repairs specifically for your workspace

- cleaning and maintenance of your workspace

- Additional phone line dedicated only for your workspace

Indirect expenses

Indirect expenses are home-wide expenses. You can deduct a percentage of total indirect expenses. The percentage is typically calculated as the square footage of the home office divided by the square footage of the entire home. (This is referred to as the “business use percentage”.) Examples of indirect expenses include:

- mortgage interest

- real estate tax

- rent

- home or rental insurance

- utilities

- home-wide repairs

- HOA/AOAO dues

- home security system

You can also write off depreciation of your home (initial cost of the building, plus improvements).

When tallying up your home expenses, include the amounts you paid during the year. But no earlier than the date you started using your home for business. Anything you paid before your business was running is not deductible.

Exception: If you itemize deductions on Schedule A (vs standard deduction), then a portion of your mortgage interest and real estate taxes may possibly be written off as home office deductions, regardless of the amount of your business income. However, keep in mind that these expenses are split between the home office and itemized deductions, so the total amount deducted would be the same, anyway.

Simplified Method

Under the simplified method, the deduction is $5 per square footage of your home office, up to 300 square feet. That makes the maximum possible deduction $1,500.

If you’re looking for a quick and hassle-free way to calculate the deduction, this might be the method for you. Calculation is super easy, you don’t have to track expenses, and all you really have to know is the how big each your home and home office is (the simplified method didn’t get its name for nothing).

However, when you think about all the costs of running and upkeeping your home, your deduction using the actual method will most likely far surpass the deduction under the simplified method. Ultimately, it will be up to you decide if the simplicity of this method is worth the decrease in the deduction.

How do I report the home office deduction?

If you are using the actual method, amounts will be reported on Form 8829, Expenses for Business Use of Home. The total deduction on this form will then be reported on Schedule C, in the box for the home office deduction. If you are using the simplified method, there’s no extra form needed; you would report the square footage and deduction amounts directly on Schedule C. Regardless of what method you use, your deduction for home expenses is generally limited to your business net profit for the year.

Keep in mind that tax software (yours or your tax pro’s) should handle these forms for you.

With this “Self Employed Tax Savings Starter Kit”, you’ll get to know the top business deductions available to you as a self-employed biz owner, plus the steps to implement during the year so you can maximize your tax saving potential & slash your tax bill (while staying compliant and legit).

Snag your kit for only $9 (psst! it’s also a biz tax write off 🤫)

Want a simple way to track and calculate your home office deduction?

This Excel spreadsheet workbook will handle the complicated calculations of your home office deduction for the year, and organize everything to make reporting your deduction much more simpler.

All you have to do is enter your home expenses, add some information about your home, and the workbook will do the rest for you.

Want more information? Click the button below: