Save more money this tax year.

With this “Self Employed Tax Savings Starter Kit”, you’ll get to know the top business deductions available to you as a self-employed biz owner, plus the steps to implement during the year so you can maximize your tax saving potential & slash your tax bill (while staying compliant and legit).

Jam-Packed With Awesomeness...

Jam-Packed With Awesomeness...

Self Employed Biz Owner’s Guide to Business Deductions

A look inside the biggest business deductions that will keep more of your hard-earned money in your own pocket–including the personal expenses that you may be able to convert to biz tax write offs. Includes cheat sheets to make determining your own deductible expenses that much easier.

Tax Savings Tasks Checklist

Shows the exact steps to putting systems in place during the year that will not only help you get the most tax savings from your deductions, but also stress less about it when “tax season” rolls around. Also includes a list of weekly and monthly money-saving tasks.

Deduction Documentation Guide

Understand the records you should be keeping to validate and legitimize each of your deductions, so you can write them off confidently.

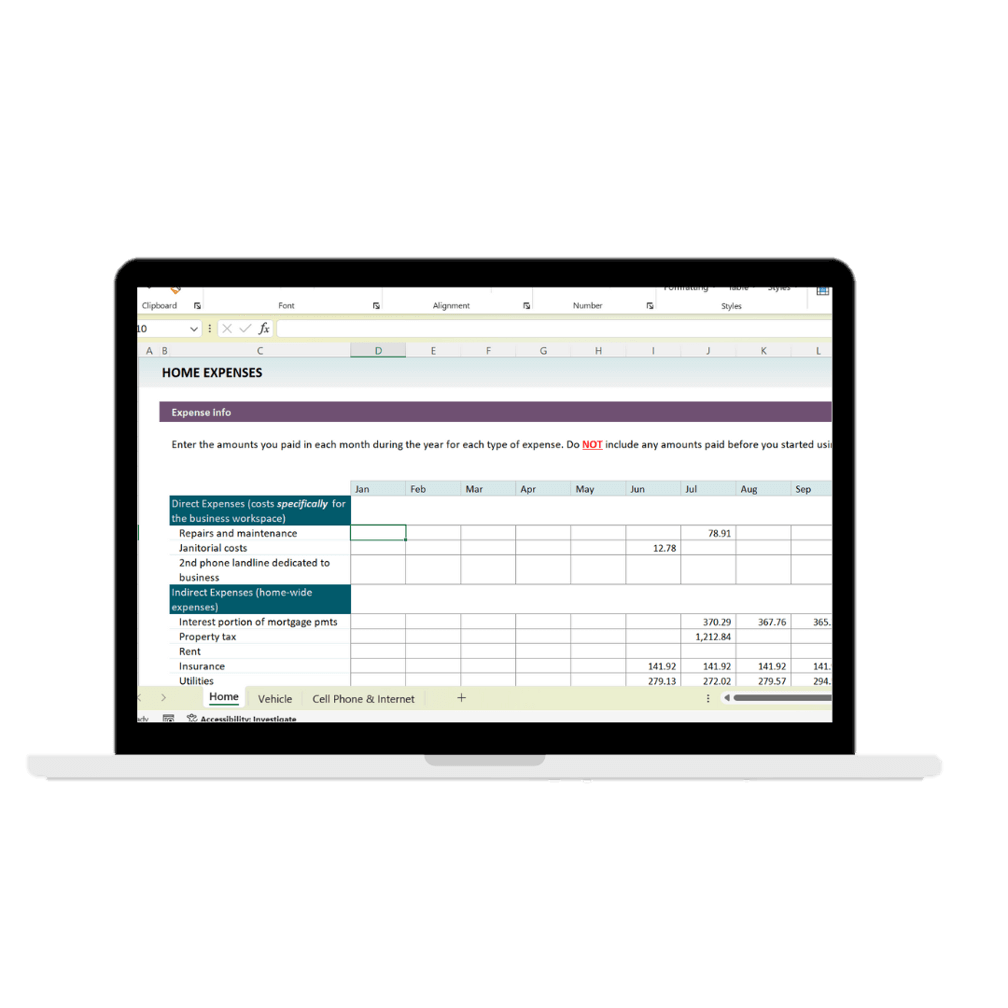

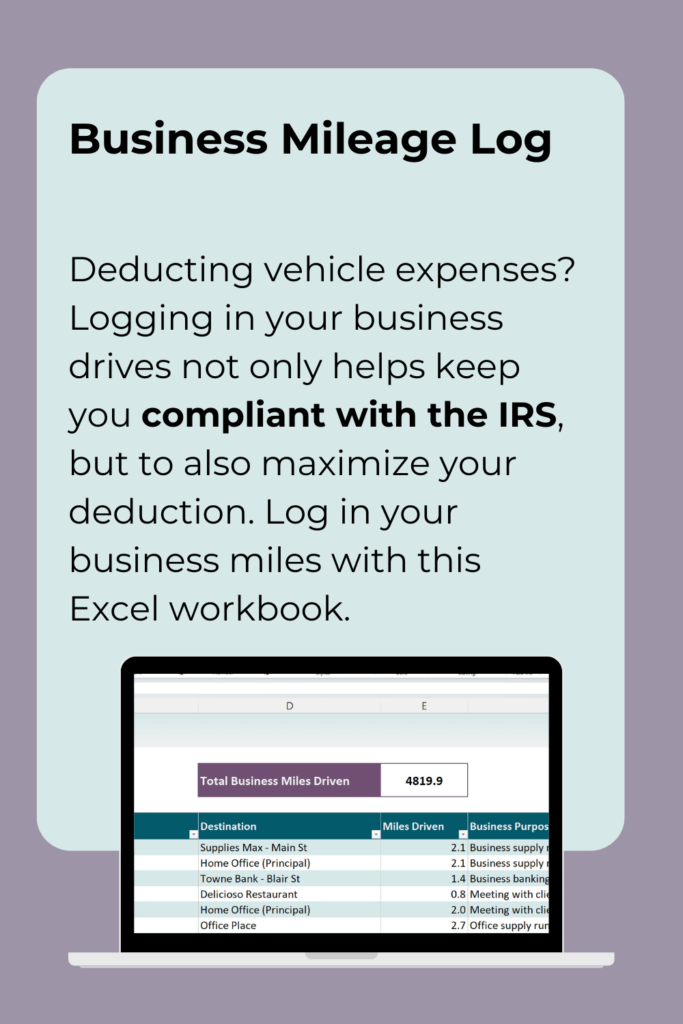

Deductible Personal Expenses Tracker

Use this Excel workbook to maximize the personal expenses that can be converted to business deductions each year.

Bonus…

All yours for only $9 (tax-deductible)

Who Will Benefit Most From This?

This is for you if:

This is NOT for you if:

❌Your business is a partnership or has special tax treatment (S corporation, C corporation)

❌You’re looking for a “quick fix” for preparing your taxes (you still gotta put in the work, boo!)

❌You are not a cash-basis taxpayer (cash basis means you pay taxes based on sales collected minus expenses paid. Most service-based and digital product-based small biz owners use cash method for taxes.)

❌You and/or your business are not based in the U.S.

You’re why I do what I do…

So here I was, in public accounting with grand ambitions. On my way up the corporate ladder. When something stopped me in my tracks.

You.

Well, small business owners like you. During my time in public accounting, I got to work a wide range of clients. But it was the small biz owners that made the job worthwhile. The passion-filled, hard-working, (slightly crazy) risk-takers who dared to go against the grain, and turn a dream into something real. To create and build something wonderful, to call their own. And being able to be a part of that with them? There aren’t words to describe the feeling.

So almost 10 years, 1 CPA license, thousands of tax returns & financial statements, and twice as much cups of coffee later…and I’m still blessed to get to partner with small biz owners like you on their business journey. To use my skills and experience to help them build a sustainable, profitable, yet passion-driven business. And of course, plan and save on taxes along the way.

And hopefully, this course will be my opportunity to join and help you on even this small part of your biz journey. What do you think? You in?

Ya’ Numbers Girl,

Vee

DISCLAIMER: Use of this product does not guarantee accuracy, desired results, or avoidance of penalties. The product, or any other content and information provided does not constitute legal, financial, tax, or any professional advice. It does not constitute a professional-client relationship. Consult with your professional.