7 Deadly Bookkeeping Sins: Avoid These Quickbooks Online Mistakes

DISCLAIMER: The content provided is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Always consult with a professional.

#7 - Overtrusting QBO suggestions in the bank feed

#6 - Half Reconciling

#5 - Not matching customer payments to the deposit

- Left navigation->+New->Bank deposit

- Select the customer payments and fill in the remaining information

- Then, you can match the deposit to the bank feed to your created deposit.

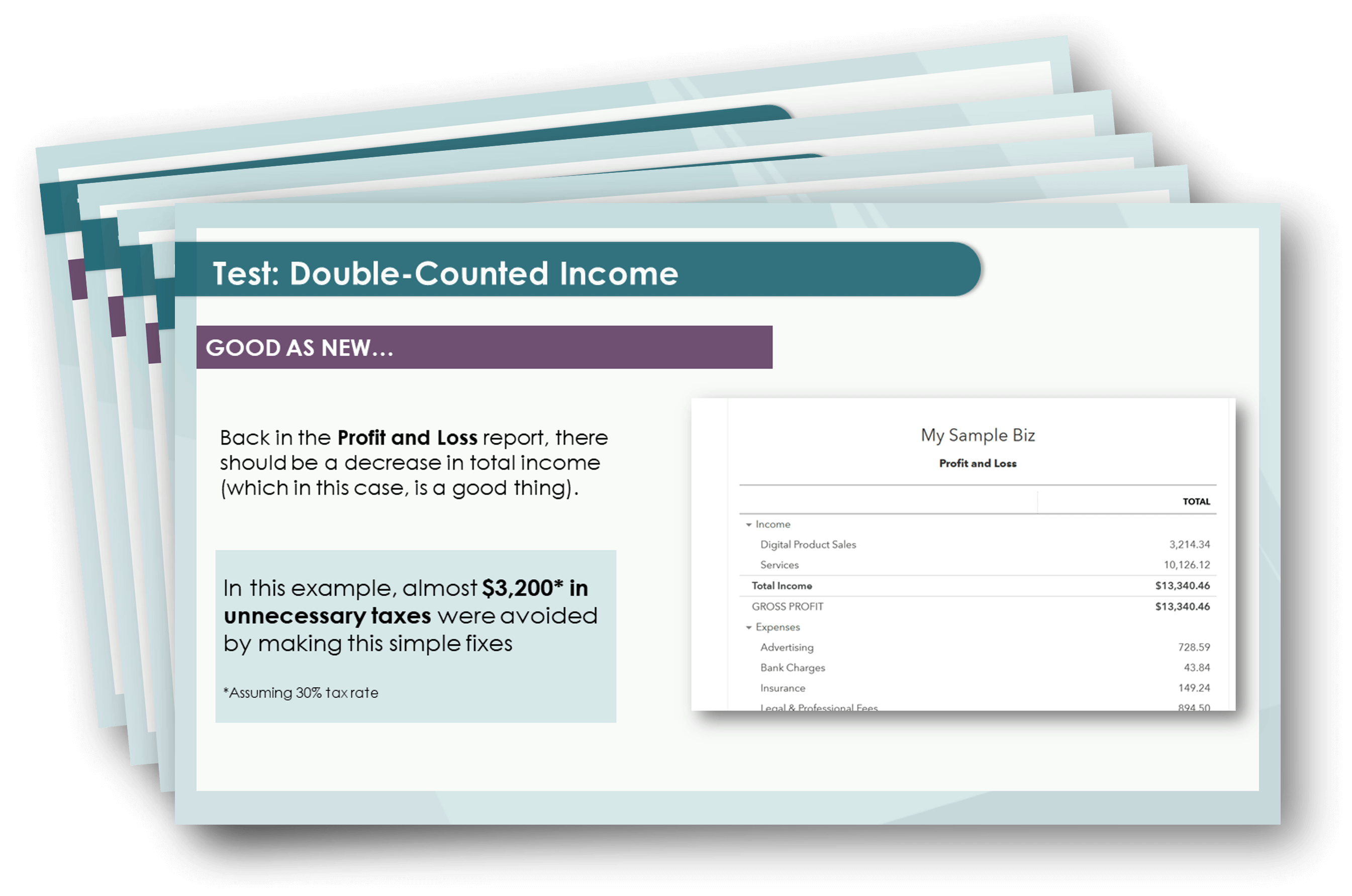

BTW…want a way to find out if there’s duplicate income in your QBO, so you can avoid wasting money on paying taxes on income that doesn’t exist?

Check out the Quickbooks Online Mini Audit: Double-Counted Income. In this PDF, you’ll learn the exact steps to uncovering–and fixing–duplicate income that may be hiding out in your QBO. Download your mini audit for only $7 ⤵️

#4 - Sub-sub-sub...accounts

#3 - Not tracking potential 1099 vendors

- you pay for services or rent with checks (including e-checks), cash, or funds transfers

- are lawyers

- are both not lawyers and not taxed as an S corporation (you can get this info by requesting a W-9 from them)

Qhen you determine your potential 1099 vendors, edit their vendor detail, and select “track for 1099s”.

#2 - Recording checks directly from the bank feed

#1 - Waiting until it's too late to get help

We're here to help!

Less wasted money. More reliable data.

Why pay taxes on phony income? Or make big business decisions with faulty info? This QBO mini audit will show you the exact steps to finding and fixing duplicate income that could be lurking on your books.