Less wasted money. More reliable data.

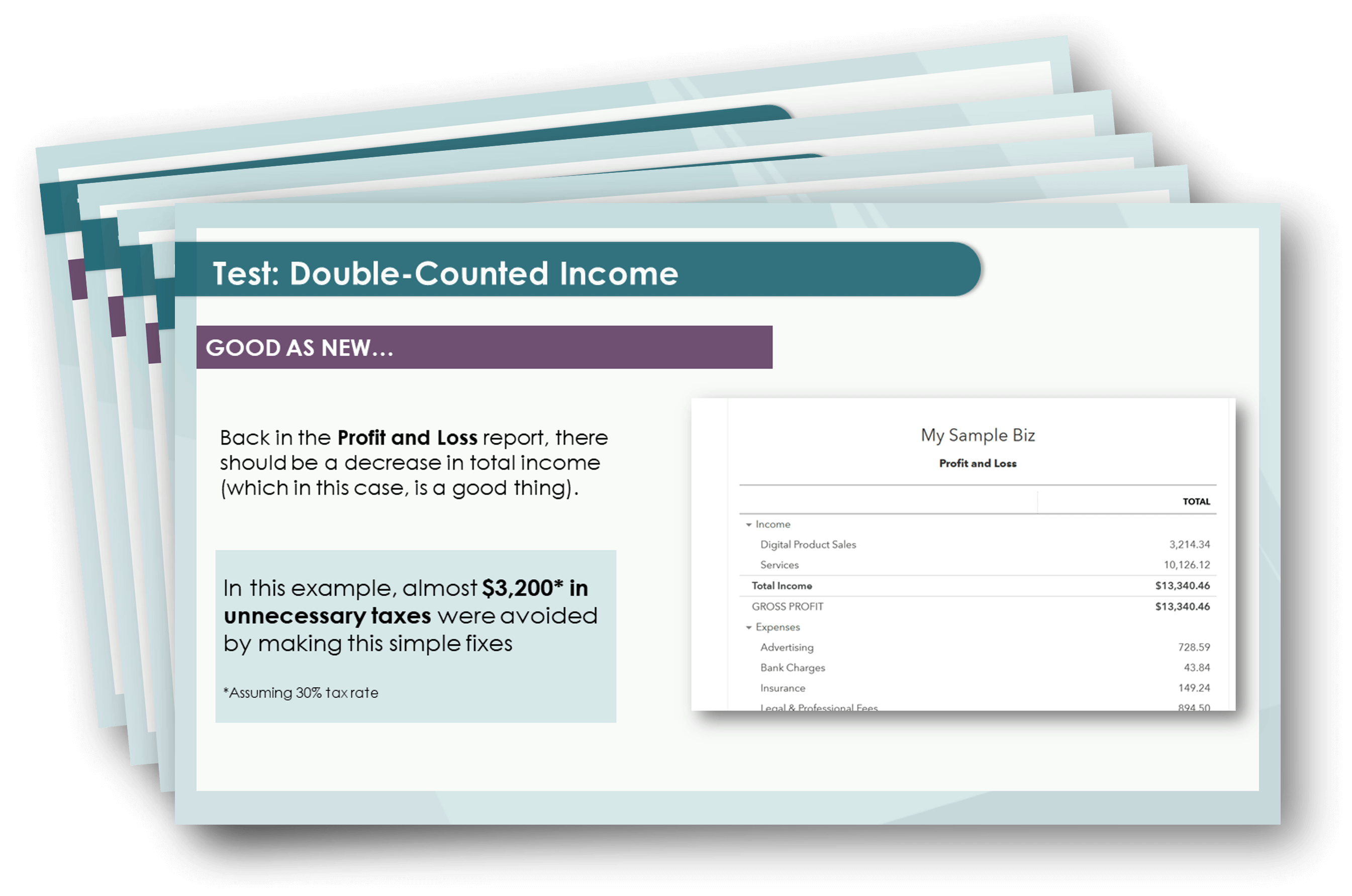

Why pay taxes on phony income? Or make big business decisions with faulty info? This QBO mini audit will show you the exact steps to finding and fixing duplicate income that could be lurking on your books.

For U.S. based users only

Let’s be real…using Quickbooks Online can be complicated.

And it’s actually almost too easy for duplicate income to creep into the books when using QBO.

And that could lead to double-paying taxes. Or making misinformed decisions about your business. #nothanks

In this PDF mini audit, I’m breaking down my one of my favorite QBO diagnostic tests so that you can…

- Easily spot double-counted income on your books.

- Understand how to correct any duplicate income

- Take steps to improve the reliability of your numbers

You’re why I do what I do…

So here I was, in public accounting with grand ambitions. On my way up the corporate ladder. When something stopped me in my tracks.

You.

Well, small business owners like you. During my time in public accounting, I got to work a wide range of clients. But it was the small biz owners that made the job worthwhile. The passion-filled, hard-working, (slightly crazy) risk-takers who dared to go against the grain, and turn a dream into something real. To create and build something wonderful, to call their own. And being able to be a part of that with them? There aren’t words to describe the feeling.

So almost 10 years, 1 CPA license, thousands of tax returns & financial statements, and twice as much cups of coffee later…and I’m still blessed to get to partner with small biz owners like you on their business journey. To use my skills and experience to help them build a sustainable, profitable, yet passion-driven business. And of course, plan and save on taxes along the way.

And hopefully, this course will be my opportunity to join and help you on even this small part of your biz journey. What do you think? You in?

Ya’ Numbers Girl,

Vee

DISCLAIMER: Use of this product does not guarantee accuracy, desired results, or avoidance of penalties. The product, or any other content and information provided does not constitute legal, financial, tax, or any professional advice. It does not constitute a professional-client relationship. Consult with your professional.