IRS Quarterly Estimated Tax Payments: The Ultimate Guide for Self-Employed Business Owners

You know who really loves taxes?

Uncle Sam.

In fact, he loves it so much, he doesn’t just want to collect once a year; he wants to get his cut all year long. This actually goes for all U.S. taxpayers. But as a self-employed biz owner, you don’t have the luxury of someone withholding and paying it in for you. Instead, you’ll have to estimate your taxes for the year, and pay it off every quarter. As if we don’t have enough to do or think about already…

But don’t stress! We’ll be breaking down everything you need to know about paying estimated taxes to the IRS. By the end of this, you’ll be rockin’ those quarterly tax payments like a pro.

DISCLAIMER: The content provided is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Always consult with a professional.

Do you need to pay quarterly estimated taxes?

If you expect to owe at least $1,000 in taxes out-of-pocket (after any withholdings) to the IRS for the tax year, then you are required to make estimated payments.

Obviously, you won’t actually know for sure until after the year ends. So what I tell business owners is, as my general rule of thumb, if you think that you will make at least $4,000 in business profit during the year, you should probably plan on making quarterly payments.

But if in doubt, you may want to err on the side of caution and just make quarterly payments.

What happens if you don’t pay?

If you skip payments—or even underestimate—there’s really not much the IRS can do about it. Except, of course, slap you with a penalty. We generally refer to this as the “estimated tax penalty”. The penalty rate changes each year, but is typically around 3-8% of the underpaid taxes, pro-rated quarterly.

To put that into context, that’s about in line with typical mortgage interest rates. In my decade of working in taxes, I’ve seen business owners have to fork out hundreds, even thousands of dollars in penalties alone for not making estimating tax payments.

When are quarterly payments due?

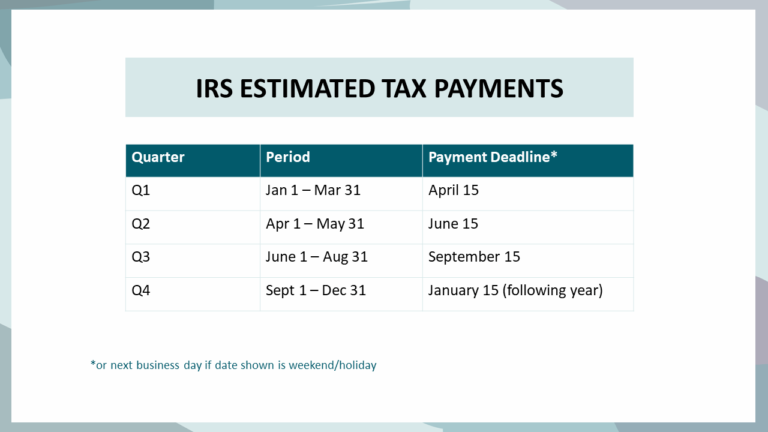

The deadline for each quarterly payment is the 15th of the month following the end of each tax quarter. If that lands on a weekend or holiday, then the due date will be pushed to the next business day.

And I say “tax quarter” because they don’t exactly follow the typical quarters of the year.

- Q1 ends 3/31

- Q2 ends 5/31

- Q3 ends 8/31

- Q4 ends 12/31

Because the timing is wonky, it may be a good idea to put the due dates into your calendar ahead of time, and as a recurring event, so you don’t accidentally miss a deadline.

How much to pay in quarterly taxes?

To avoid the estimated tax penalty, there are two ways you can calculate your taxes.

Method 1: Safe Harbor

By far the easiest way to calculate your quarterly payments is using the safe harbor method. It’s a “safe harbor” because when used correctly, it allows you to bypass the actual full required calculation of quarterly taxes, without worrying about being charged any estimated tax penalties.

You’ll first determine what I like to call your “prior year (PY) tax baseline“. If your adjusted gross income last year was more than $150,000 (or $75,000 if you’re married filing separately), then your PY tax baseline is 110% of last year’s total tax. Otherwise, it’s 100% of the tax.

From there, you just divide your PY tax baseline by 4. That will be your payment each quarter.

Easy, right? Here’s the caveat.

Like I mentioned earlier, the safe harbor only covers you if you use it correctly. That means you must make 4 equal, on-time payments, which total at least your PY tax baseline.

So say you didn’t start your business until the middle of the year, or you requested a filing extension on last year’s tax return. Then chances are you’ll miss the first one or two quarters, at least. In that case, the safe harbor technically won’t cover you.

This method may also not make the most financial sense for you if your income fluctuates throughout the year.

But you can still avoid penalties by using the next method.

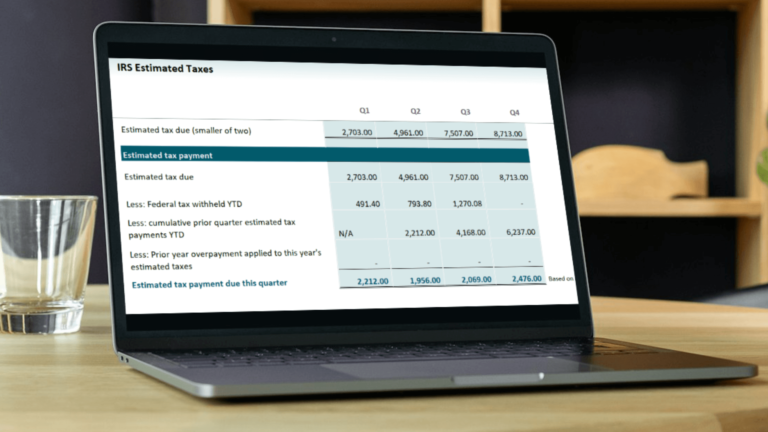

Method #2 – Full Calculation

Not gonna lie. This method is MUCH more involved and complex. With this method, you’re calculating what the IRS actually requires you to pay in (assuming you’re not covered by the safe harbor).

That will be the smaller of your:

Prior year (PY) tax baseline

Current year (CY) tax baseline [90% of your current year tax bill]…

…prorated for the quarter you’re calculating.

Performing a full calculation is doable. Cumbersome. Complicated. But doable. If you want to skip through the overwhelm of the calculations, then the quickest and easiest way to figure out your IRS quarterly tax payments is to simply use an estimated tax calculator.

There’s an Excel workbook you can check out below that will estimate your quarterly taxes, as well as how much to put aside each month to save for taxes; you just need to plug your income, deductions, and other simple tax info.

With that said, let’s look at the breakdown of this calculation method. I’ll walk you through the main parts, and then share a video below that shows you how the full calculation all comes together.

We already saw how to calculate the PY tax baseline. And that’s pretty much the easiest part of the entire calculation. The CY tax baseline is the tricky part, because we don’t know what our current year tax will be until next year.

That’s where the estimating comes in. More specifically, we need to estimate our income for the year, and calculate the total tax based on that estimated income. As a self-employed biz owner, you’ll need to estimate your total income to calculate income tax, and your business profit to calculate self-employment tax. The CY tax baseline will be 90% of the total taxes.

But let’s talk about estimating income.

The thing about estimated taxes is that they’re just that—estimates. There’s no exact science to this. With that said, you can still be penalized if you estimate wrong.

So when it comes to estimating your income, it’s best not to estimate at all. Or rather, we don’t want to take a gamble and simply guess here. Instead, you can “estimate” your income by using a method called the annualization of income.

This is just a fancy way of saying that for each quarter, you’ll take your actual income from the beginning of the year to the end of the quarter, and projecting it to the end of the year. You do this by multiplying the income by the annualization for that quarter.

For example, if you were annualizing Q1 income, you would multiply your income by 4 (12 month in the year total/ 3 months in the year to date).

Once you have your annualized income amounts (for each total income and business profit), it’s mostly just a matter of figuring out your income tax using the income tax schedules (which are provided on form 1040-ES), plus your self-employment tax (estimated biz profit x 92.35% x 15.3%). Your CY tax baseline would be 90% of the total of those taxes.

Annualized income is actually what used for calculating the estimated tax penalty. So using this method to estimating your income for quarterly payments can help you drastically minimize—even altogether avoid—any estimated tax penalties.

Plus, it can be more beneficial from a cash flow standpoint, especially if you have uneven income throughout the year. When you annualize income to calculate quarterly payments, you’ll end up paying less of your tax bill in quarters where income is lower, and make up for it in quarters when income is higher.

Sometimes showing is better than telling, so check out this vid to see the gist of how the full calculation works.

Keep in mind that with the full calculation method, you should perform the calculation each quarter, so that the corresponding tax payment accounts for the changes in income throughout the year.

Again, if you want a simple way to do this, check out this Excel workbook.

How do you make payments?

Although there are technically several ways you can make quarterly payments to the IRS, I’ll share the top two ways.

Best option

The easiest and least hassle way to make your quarterly payment is to do it online through the IRS website. There’s no sign in or account creation required. You just need to follow these steps:

- From the direct pay page, you’ll select the “Make a Payment” button.

- Select “Estimated Tax” from the dropdown as your reason for payment and continue.

- Confirm your identity. For this, you’ll select a tax return from any of the recent prior years. Then enter the name, filing status, address, that matches the ones on the tax return you selected (this part is usually so easy, you probably don’t even need to look at the return). You’ll also enter your SSN and date of birth.

- In the next window, enter the amount you’re paying for the quarter. Schedule the payment date, and add your bank account information. Continue on to review and confirm your payment.

This process usually takes a few minutes, tops. Be sure to save your payment confirmation for your records.

You can watch this quick vid of the process here:

Alternative option

If you want to go old-school, you can also send your payment in the mail by check. Include the voucher for the corresponding quarter in the form 1040-ES (vouchers are on the last pages), and mail to the address in the instructions.

Pro tip: If you decide to pay by check, consider doing it by certified mail. You won’t get a confirmation or receipt for your mailed payment. Which means that if you ever had to prove that you made the payment, it would be your word against theirs. (Even if the check gets cashed.) Sending it certified will not only be your proof that you paid, but when you paid. Speaking of, make sure it gets postmarked by the due date for it to be considered paid on time.

Also, you may want to scan a copy of your check and voucher, just so you don’t lose track of how much you paid.

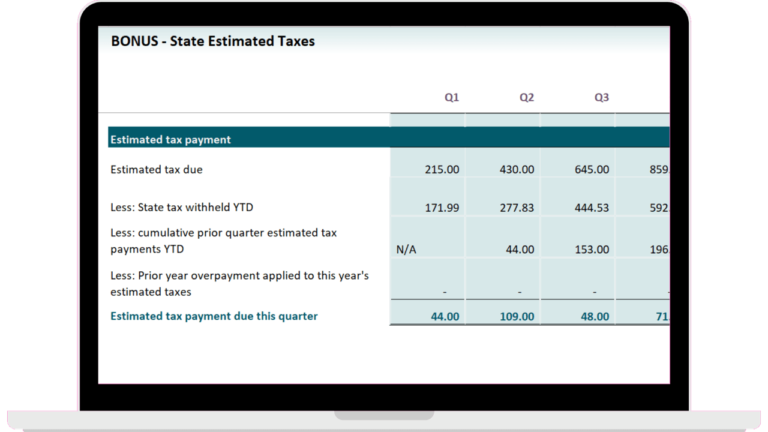

Don't forget about your state

Most states also require quarterly tax payments. Check with your state about any specific requirements, including due dates. As far as how much to pay in, the rules vary from state to state. But you can use the Excel workbook as a guide in helping you figure out your state payments as well.

Next steps...

So now you’re equipped with everything you need to know about quarterly estimated taxes. Now, it’s a matter of planning out your cash flows, so you don’t have to worry about covering your tax bill. For more on budgeting for taxes, check out this post.