Calculate your quarterly estimated taxes the easy way.

Let this “Quarterly Estimated Tax Payment Calculator for Self-Employed Biz Owners” Excel workbook handle all the complicated calculations for you. Just plug in your income, deductions, and other tax info–and let it work it’s magic for you.

For the 2024 tax year.

See what's inside...

See what's inside...

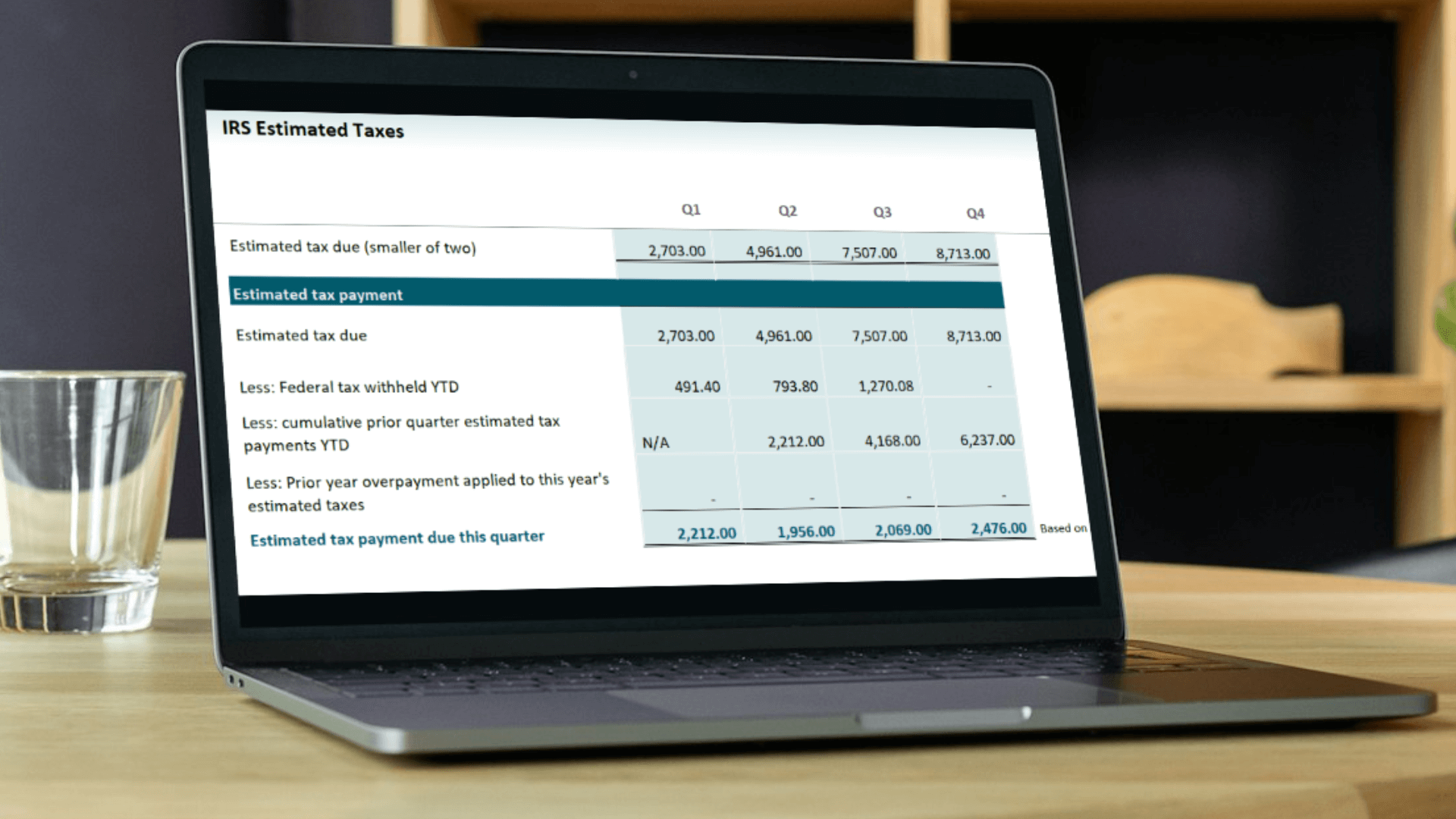

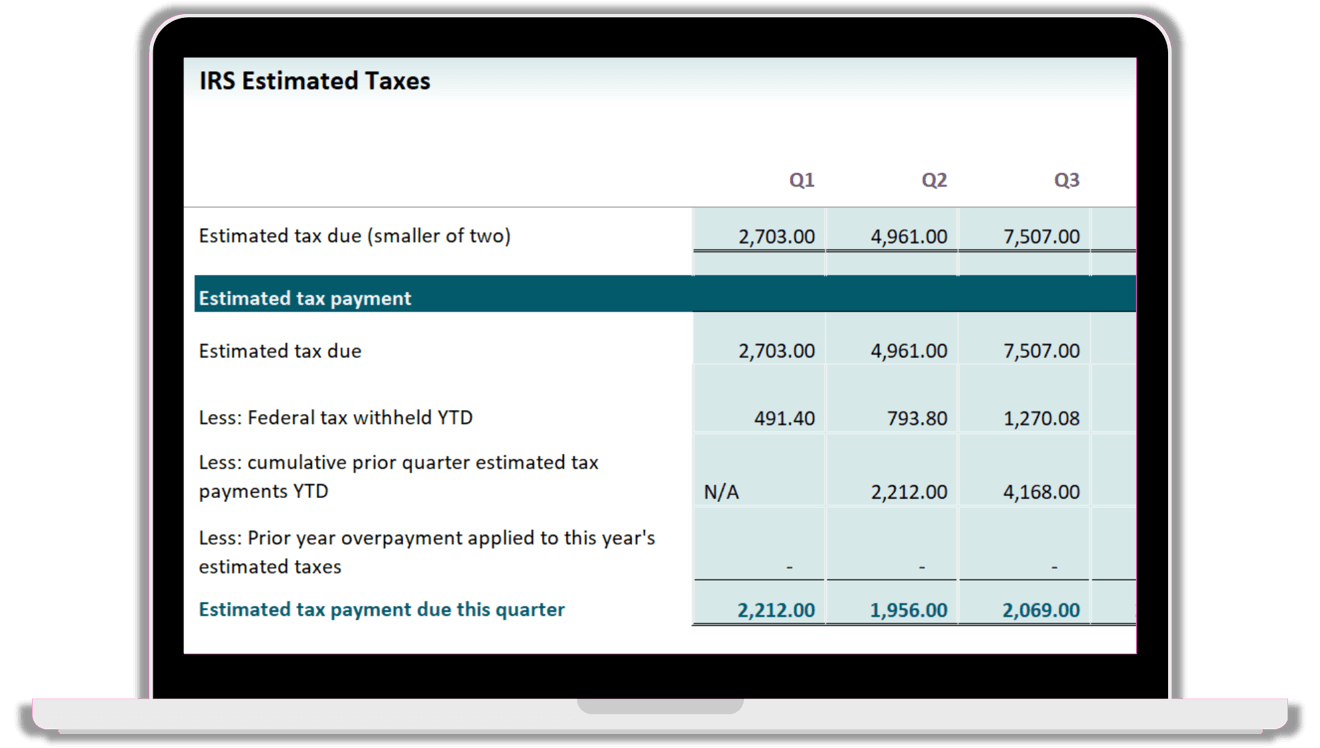

IRS Estimated Tax Calc

Quickly figure out what to pay the IRS each quarter to reduce–or even eliminate–hefty penalties, and without worrying about paying in too much money for taxes (‘cuz you got better things to do with your money during the year).

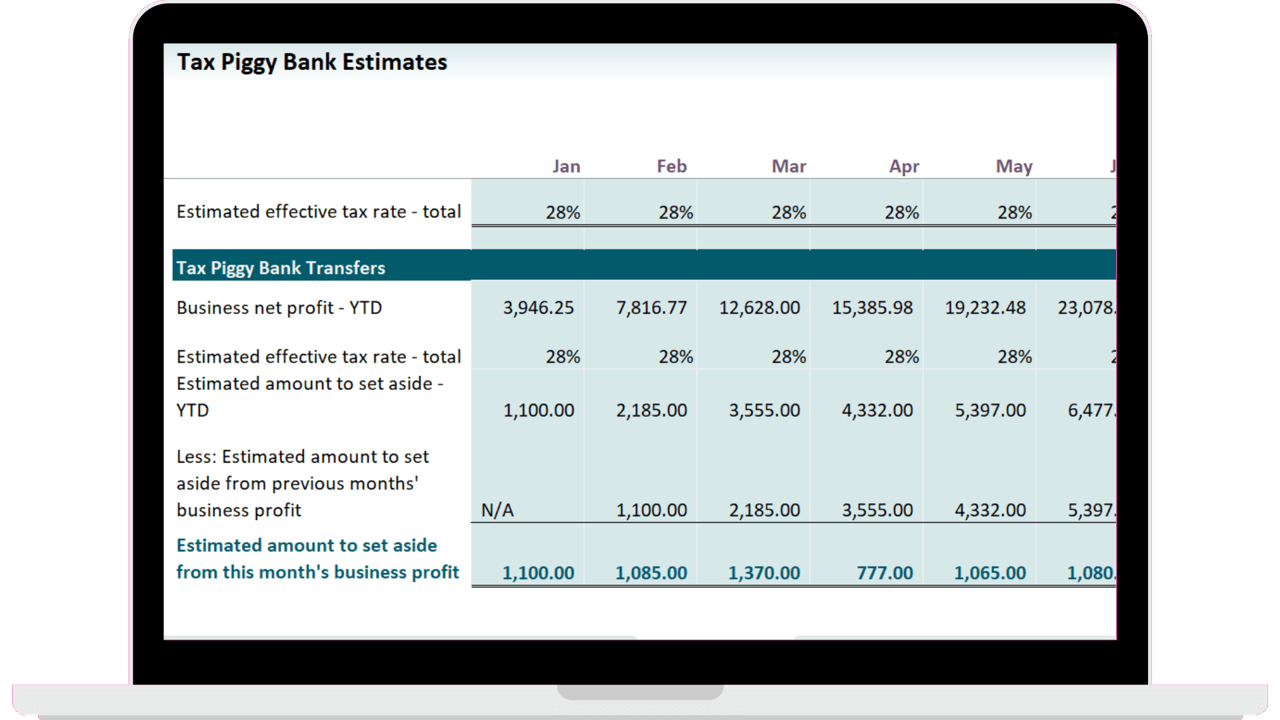

“Tax Piggy Bank” Savings

Avoid the all-too-common cash crunch that comes with paying taxes. This workbook will estimate how much of your business profit you should put aside each month so you can cover your tax bill without the stress.

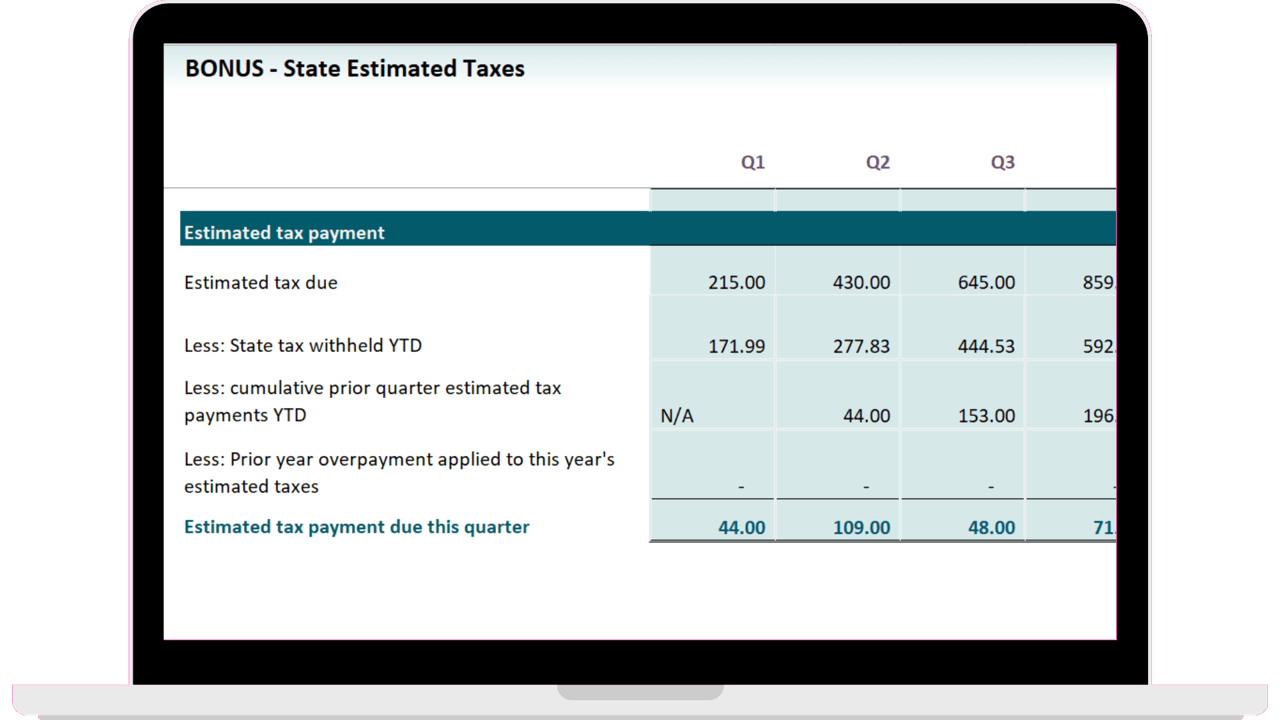

Bonus…

State Estimated Tax Calc

Most states also require you to pay quarterly taxes. Use this calculation as a guide in determining how much to pay in to your state.

All yours for only $17

(Just think…for less than a typical “dashed” delivery, you could potentially save hundreds of $$$ in wasted penalties. Not to mention the stress.)

Who Will Benefit Most From This?

This is for you if:

This is NOT for you if:

❌Your business is a partnership or has special tax treatment (S corporation, C corporation)

❌You don’t consider yourself to own a business

❌You and/or your business are not based in the U.S.

Frequently Asked Questions

Not much. This is an Excel workbook, so it will function properly in Microsoft Office. Other than that, you need internet access to download the workbook.

After you checkout, you will be taken directly to the page to create a password and download your workbook. You’ll also get an email for the link to the page.

Login anytime with your email and password.

No worries, all the calculations are cumulative. Which means not only can you start using this workbook at any point of the year, but it will figure how much you need to “catch up” to the current period.

You’re why I do what I do…

So here I was, in public accounting with grand ambitions. On my way up the corporate ladder. When something stopped me in my tracks.

You.

Well, small business owners like you. During my time in public accounting, I got to work a wide range of clients. But it was the small biz owners that made the job worthwhile. The passion-filled, hard-working, (slightly crazy) risk-takers who dared to go against the grain, and turn a dream into something real. To create and build something wonderful, to call their own. And being able to be a part of that with them? There aren’t words to describe the feeling.

So almost 10 years, 1 CPA license, thousands of tax returns & financial statements, and twice as much cups of coffee later…and I’m still blessed to get to partner with small biz owners like you on their business journey. To use my skills and experience to help them build a sustainable, profitable, yet passion-driven business. And of course, plan and save on taxes along the way.

And hopefully, this course will be my opportunity to join and help you on even this small part of your biz journey. What do you think? You in?

Ya’ Numbers Girl,

Vee

DISCLAIMER: Use of this product does not guarantee accuracy, desired results, or avoidance of penalties. The product, or any other content and information provided does not constitute legal, financial, tax, or any professional advice. It does not constitute a professional-client relationship. Consult with your professional.