Do I Need To File 1099s? 3 Steps to Figuring It Out (Plus 1099 Filing Tips)

So you found out that you might have to file 1099s.

Great.

Because owning and running a business wasn’t complicated enough already.

Now you have to figure out who you have to file 1099s, or if you even have to file at all. And it’s hard to be exactly sure, because there are PAGES and PAGES of instructions to go through. And bonus! The rules changed this year, so you now you have to figure out which type of 1099 to file, too?

Boss, I know you don’t want to read that novel of an instruction guide, especially when it seems like it was written in gibberish. Trying to figure out who gets a 1099 doesn’t have to be that complicated. All you need to do is ask yourself these 3 questions about each of your payees to see exactly which of them you need to file 1099s for, as well as which type of 1099 to file.

Question #1 – What did you pay them for?

Typically, a business may have to issue 1099s for two types of payments:

- Payments for rent. This basically includes rental of commercial property or machinery

- Payments for services. This would payments to anyone (other than yourself) who is not your employee that did any type of work for your business. Some of the usual ones would include (but not limited to):

- Independent contractors

- Legal, accounting, and other professional services

- Coaching and consulting

- Marketing, branding, and design services

- Administrative services

- Repairs and maintenance

So, if you paid any of your payees for rent or services, you MAY have to file 1099s. Move on to the next question. (If you didn’t, you don’t have to file for this payee.*)

*Technically, there are other kinds of transactions that may trigger a 1099 requirement (I call these “special transactions”), but these are much less common for small businesses, so I won’t really go into them in this article. But for your reference, special transactions include:

➡️Trading services with another business

➡️Giveaways

➡️Payments for medical services (business related)

➡️Royalties

➡️Boat proceeds

Question #2 – How much did you pay them during the year?

You may be required to file 1099s for payees you paid at least $600 during the tax year. You should know that for 1099 filing purposes, that only includes amounts paid with:

- Cash

- Checks (including electronic checks)

- Funds Transfer (including electronic transfers, and cash transfer or peer-to-peer apps like Zelle or Venmo Friends and Family**)

- Basically any direct payment out of your bank account

Any amounts you paid with card (credit, debit, gift) or Paypal should not be counted when summing up your payments. That’s because the payment processors will be responsible for issuing their own 1099s for those amounts.

But if your total cash, checks, and funds transfer total up to at least $600 for the payee in question, you may need to file 1099s. Move on to the next question. (If not, you don’t have to file for this payee.)

**SIDE NOTE: You really don’t want to use peer-to-peer apps for business transactions. They weren’t set up for that use, and apps like Venmo have actually been known to reverse payments made for business purposes.

Question #3 – What kind of business/entity is your payee?

For the most part, you don’t have to file or issue 1099s to anyone that is a corporation, or an LLC being taxed as a corporation.

(Attorneys are an exception to this rule. It doesn’t if they’re a corporation or not, if your business paid them enough, they’re getting a 1099.)

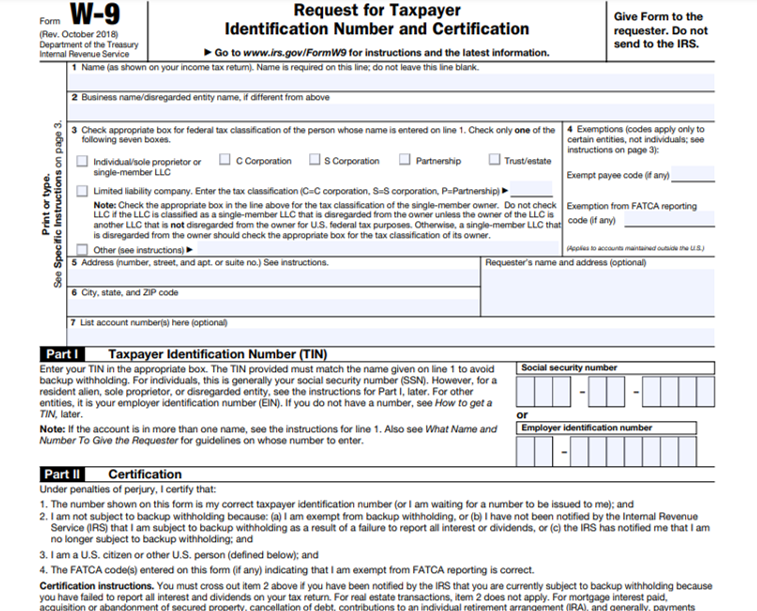

But how the heck would you know what entity your payee is? Simple. You ask them. More specifically, you would give them a form W-9 to fill out. We use W-9s to gather information about our payees for 1099 purposes.

You’ll want to give a W-9 to anyone who you might potentially require you to file (i.e., the people you pay for rent or services).

(Here’s a link to download the W-9 from the IRS website)

So, if your payee is either an attorney or a non-corporation, and you’ve made it through all the questions, you have to file a 1099 for this payee. (Otherwise, you don’t have to file.)

IF YOU HAVE TO FILE…

If you paid them for services, you will file and issue the form 1099-NEC (Non-Employee Compensation). If you paid them for rent, you will use form 1099-MISC (Miscellaneous).

By the way:

If you’re a self-employed biz owner looking for a simple bookkeeping system that can track 1099 payments, tell you exactly who to file for and which forms to file, check out my “Excel Accounting System for Schedule C Filers”. This is an enhanced Excel spreadsheet workbook designed to automatically organize your 1099 and Schedule C business income for you. For more info, check out this link.

SO…WHAT’S NEXT?

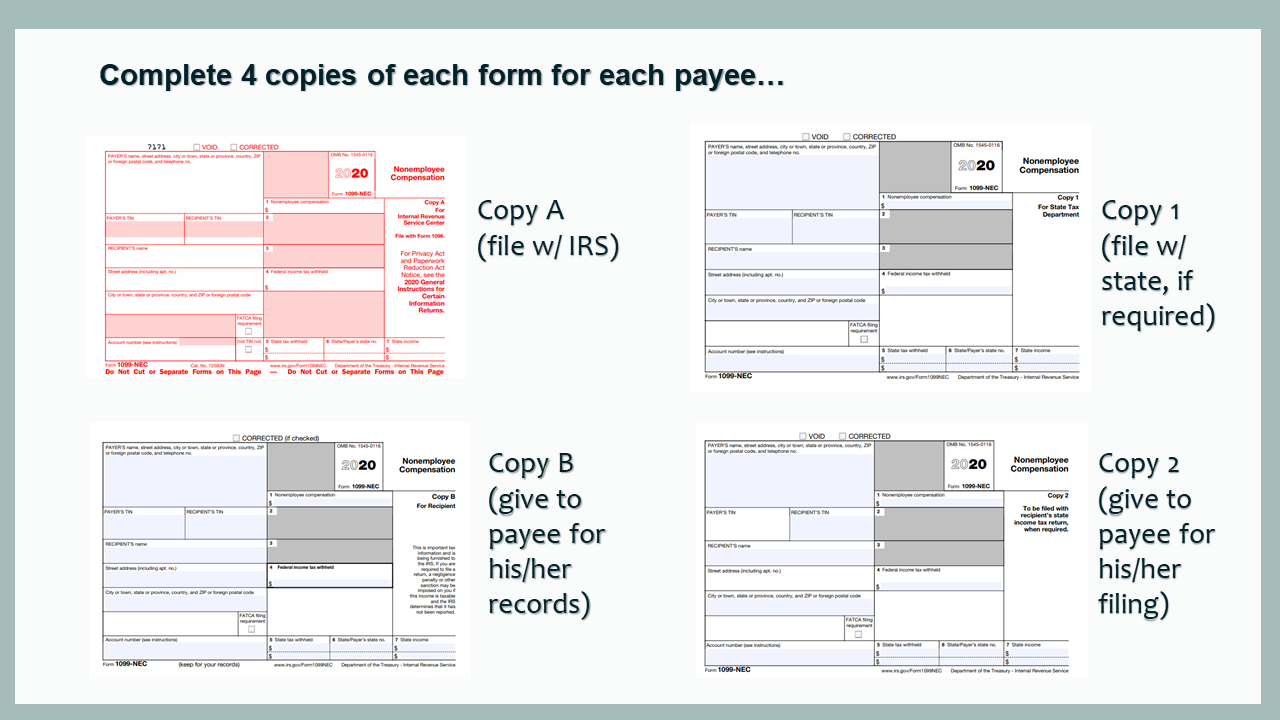

Now that you know who you need to file for and which 1099 forms need to be filed, at this, it’s all about getting it filed. For each 1099 payee, you will report their information and total amounts paid to them on the appropriate 1099. You will complete 4 copies of each form:

- One filed with the IRS according to their rules (Copy A)

- One filed with the state, if your state requires, according to their rules (Copy 1)

- One to be mailed to your payee for his/her records (Copy B)

- One to be mailed to your payee for his/her taxes (Copy 2)

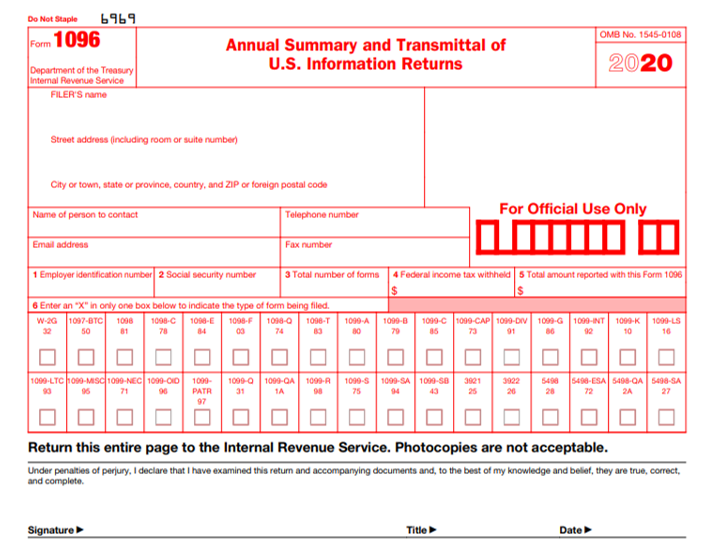

You’ll also need to fill out a summary form called a 1096. (You’ll need one form each to summarize 1099-NEC forms and 1099-MISC forms).

The fastest and easiest way to get all this done is by e-filing these bad boys. You only pay a few dollars per form to file, which is so worth it to cut down on the work and reduce errors, ‘cuz the e-filing program does most of the heavy lifting for you. There are several really good 1099 tax filing programs, but one of my favorites is Tax1099.com.

If you have less than 250 1099 payees, you also have the option of filing by paper, which is free but also more work and more complicated. You can order the necessary forms from the IRS for free here. It can take a couple of weeks to get to you, so if you need them quicker than that, you can also buy them at most office supply stores. In my experience, the paper-filed forms get rejected for error more often the e-filed forms. And errors can cost up to HUNDREDS of dollars per form.

But in any case, you are now equipped with knowledge of WHO you actually need to file for. And that already is half the battle.

(Did you enjoy this article? See this one for common 1099 filing errors to avoid).

Want to take the guesswork out of what to report for 1099s?

Hey self-employed business owners! If you are looking for a simple bookkeeping system that will calculate Schedule C income AND 1099 amounts, I’ve got just the thing.

My Excel Accounting System for Schedule C Filers is a semi-automated Excel spreadsheet workbook that has the capabilities to:

- Reconcile your bank and credit card accounts

- Determine which of your vendors require a 1099 for the year and organize all the information needed to file

- Summarize your business income and deductions for easy Schedule C filing.

Want more information? Click the button below: