10 Common Mistakes When Filing 1099s

You know what’s frustrating? When the IRS requires you to file 1099s, but makes the whole process super confusing and complicated. And yet one small error can cost you big time (like, up to $280 per incorrect return). I for one do not want you having to fork out hard-earned money for useless penalties, so I put together this list of 10 of the common errors that businesses make when filing 1099s. Just so you know what to keep your eye on when it’s time for you to file.

#1 – Clerical errors

This may seem obvious, but even a simple little typo is all it takes to make 1099 forms “rejectable”. And it happens more than you might thnik. You never want to rush when filling out any sort of 1099 information. And you want to double check all your work before you turn it in (like back in grade school). Review that you correctly entered your name, your payees’ name, all tax ID #s, and amounts paid.

(BTW, did you catch my clerical error? Just having some fun…)

#2 – Special characters

There’s nothing special about 1099s. Literally. Your forms could be rejected for using special characters, so you want to avoid using them when preparing 1099s. You especially want to stay away from using:

- Dollar signs ($), commas (,), or ampersands ($) in any boxes where you enter amounts

- Apostrophes (‘) or asterisks (;) in the recipient name line

But really, just stay away from special characters in general. Better safe than sorry.

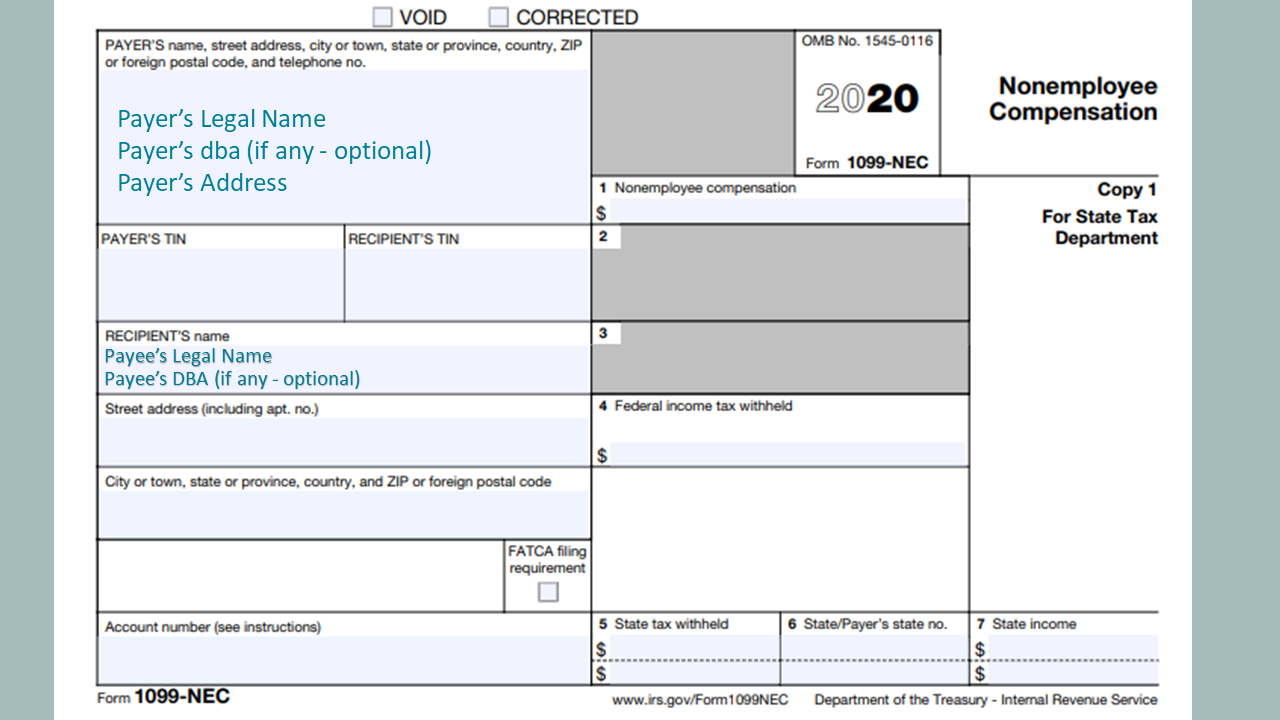

#3 – Using the DBA name instead of the legal name

The IRS couldn’t care less about your DBA. It cares about the one that’s used on tax returns. That’s the name on their records.

If you are an individual (sole proprietors or single-member LLCs), you should be entering your personal legal name when preparing 1099s. Otherwise, you would use the legal name of your business. You can also enter your DBA (if you have one) below your legal name, but that’s kind of optional. The legal name is what really matters.

The same rules also apply when entering the name of your payees.

#4 – Using the wrong tax ID #

For individuals, their tax ID # is their social security number (or, if they have one, their personal/sole-proprietor EIN). For all other businesses, their tax ID # is their business’ EIN.

Sounds simple enough, right?

I once came across a business owner who, one year, had a lot of vendors he needed to file 1099s for. He collected everything he needed from his vendors, including their tax ID #s, and proceeded to file 1099s. More than half of them got rejected.

Apparently, there was an issue with the tax ID #’s on the 1099s not matching anything on the IRS’ records. His initial thought was that his vendors must have given him tax ID #s with typos or transposition errors. So he had them resend their tax ID #s, but to his confusion, the numbers were all the same as the ones his vendors originally sent. Then he thought, “maybe I just entered them incorrectly when I prepared 1099s the first time”. So this time, he prepared them with double-extra care, making he entered the tax ID #’s exactly how it was given to him.

And again, they were rejected. And for the same reason.

He was so frustrated, he just couldn’t understand what was wrong! Well, it turns out that all the vendors whose forms were rejected were single-member LLCs. And all of them had provided them with their LLC’s EIN.

But remember, as we talked about in the previous error, single-member LLCs are individuals. So they should have provided either their social security number, or personal (sole-proprietor) EIN, not the EIN of their LLC.

You really want to be careful if your payees tell you they are individuals (sole-proprietors/single member LLCs), but provide you with an EIN. Just double-check with them that it is in fact their personal/sole-proprietor EIN.

Quick recap:

- Individuals (sole proprietors/single-member LLCs) – Use individual’s social security number (or personal/sole proprietor EIN if they have one)

- If an individual provides you with an EIN, double-check with them that it is theirs, and not their business‘

- All other businesses – Use business’ EIN

And, BTW, the same rules about tax ID #’s apply to you, the payer.

#5 – Shortening the tax ID #

Speaking of tax ID #’s (TINs), you want to be careful of “shortening” TINs when preparing forms (e.g. ***-**-9999). We call this truncating a TIN. I can totally understand why you would want to truncate TINs when preparing 1099s; I mean, it’s confidential and sensitive info, for crying out loud! But there are actually rules around doing that.

You can only truncate your payee’s TINs on their own copy of the 1099 (this would be copy B). On all other copies (the ones to the IRS and state), you must use the payee’s full TIN.

And, unfortunately, you are NEVER allowed to truncate your own TIN. You must use your full TIN on all copies of all forms.

#6 – Not filing all the 1099s you’re required to file

One year, I helped this one business owner with 1099s. I went through her books and records to determine who she needed to file for, and I sent her a list of these people and asked her to collect 1099 information from them.

Almost immediately after I hit send, she sent me the information for her 1099 “employees” (by the way, there’s no such thing. The term is 1099 contractors), then replied to me, she already collected everything a long time ago and that she just gave me everything I should need. Needless to say, she didn’t actually look at the list. And she seemed so proud of the fact that she got all this done beforehand, that I felt really bad that I had to tell her we still need information for half the people on the list.

When we file 1099s, we don’t want to just consider our 1099 contractors, but also anyone we paid to provide services, and even rent, to our business during the year. If we forget about those payees, and the IRS found out, we would be hit with late-filing penalties (or worse, penalties for intentional disregard).

For more information on who you should be issuing 1099s to, check out this article here.

#7 – Filing 1099s that you weren’t actually required to file

On the flip-side of the previous error, you don’t want to file for anyone that you really didn’t have to file for. Not EVERYONE you paid should get a 1099 from you.

Now, you’re not going to get penalized for filing 1099s you didn’t need to file. But it could mean extra and unnecessary time and effort spent on filing. Plus, it could mean a lot of headaches for your payees during tax time, because they have to report or reconcile those amounts on their tax returns.

Here are a few payees you DON’T have to file for:

- Anyone you only pay with card or Paypal

- Anyone you paid less than $600 to

- Anyone you paid for merchandise or supplies

- Anyone is a (non-attorney) corporation

See this article here for who you should be filing for.

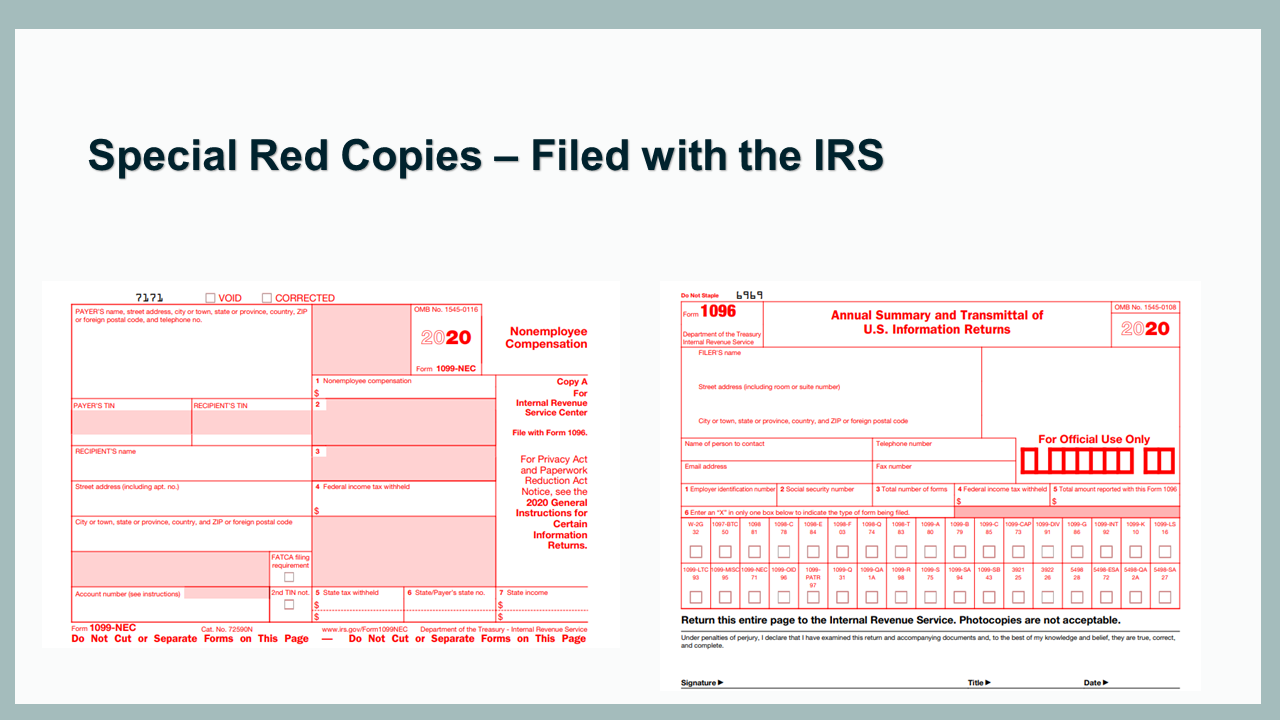

#8 – Sending all your payees a copy of their 1099…but not the IRS

There’s more to filing a 1099 than mailing one to your payees. The IRS needs to get a copy, too. In fact, they need their own special copy in their own special color:

If you’re filing on paper, you’ll need to special order these forms. You need to fill out the IRS Copy A for each 1099 payee, and you’ll also fill out a summary form 1096.

You can also file electronically using 1099 filing software, which I recommend. It’s typically few bucks per payee.

#9 – Printing the forms you file with the IRS

As mentioned in the previous error, you will need to special order any 1099 forms you file with the IRS. You can’t print them out (not even if you have a color printer). You must use the original red forms because those are scannable.

The IRS provides them for free when you order forms through them. But it can take up to a couple of weeks to get to you. You can also purchase them from office supply stores, or even Amazon.

#10 – Not checking state filing requirements

Some states don’t at all require you to file 1099s with them because they don’t collect income tax (so if you live in one of these states, lucky you).

Most other states definitely require the 1099 information. It used to be that many of these states didn’t make you file, because the IRS shared with them all the 1099 information they needed (so you only had to worry about filing with the IRS). However, there were some big changes made for the 2020 1099 filing year, so that is likely no longer the case. So make sure you look at your state requirements for filing 1099s (particularly 1099-NEC & 1099-MISC, the two types you might have to file as a business owner).

(And if you found this article helpful, read this one for tips for laying the groundwork for a successful 1099 filing season).