4 Tips for a Worry-Free 1099 Filing Season

I love filing 1099s.

Said no one ever.

There’s not a single person that is putting filing 1099s on their list of favorite things to do (and I’m saying that as an accountant that’s been doing this for years!). If anything, it’s something that adds to our stress levels. But 1099s doesn’t have to be completely terrible or stressful. In fact, by using these 4 tips, it just might even be possible to achieve a smooth sailing 1099 filing season.

#1 – Get 1099 information from you payees ASAP

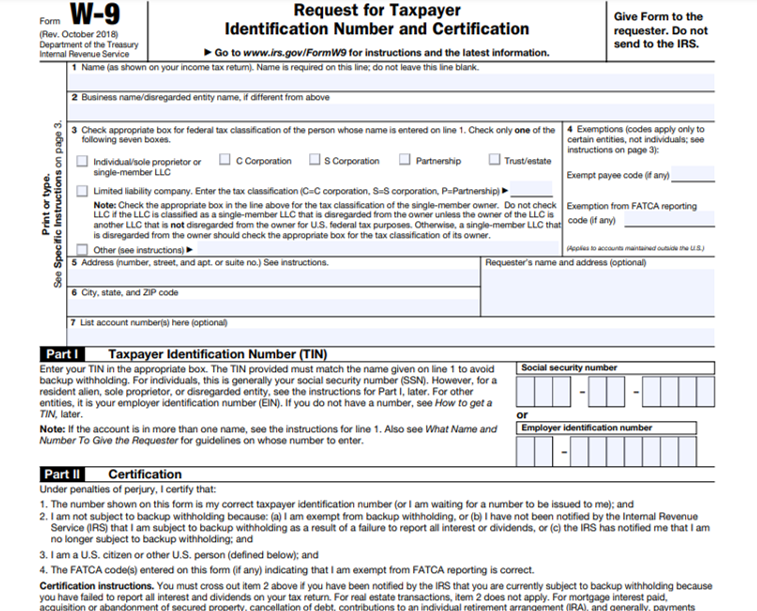

If there is anyone you think you might have to issue a 1099, collect their 1099 information as soon as possible (not sure who should get a 1099? See this article). The most acceptable way to request this information from your payees is by asking them to fill out a W-9.

The best time to request that your 1099 candidates fill out a W-9 is at the start of your business relationship, even before you’ve paid them. This is when your payees are most likely to make it a priority to fill out. The next best time is now (not to sound like the Chinese proverb). You don’t have to wait until you know for sure that you need to file a 1099 for them. If there’s a chance that you’ll have to file a 1099 for them, collect their information already. Better safe than sorry.

Collecting W-9s is something you definitely don’t want to hold off on. I cannot even describe the stress of trying to hunt down payee information at the last minute. And not getting the information from you payees on time does NOT excuse you from filing. So if you’re reading this, and there are still W-9s you need to send out and/or collect, go do that as soon as we’re done here.

Not kidding.

#2 – Update your books as much as possible before January

You’ll only know what amounts to report on 1099s if your financial records are in order. And that means making sure your books and records are current. Preferably, you want to keep your books current all year long. But you’ll definitely want to record as much of your transactions for the year as you can by December (especially the bank/checking transactions), since you’ll basically need to get all your 1099s done by the end of January.

Whether you’re using an accounting system like Quickbooks Online, or you’re going old school and using a spreadsheet, just make sure to get it up to date so that the only transactions you’ll have to have to worry about recording in January are the year-end transactions. And once that’s done, you’ll only have to focus on the actual filing part.

If you’re reading this in January and you still have to update your bookkeeping, don’t panic. Just make sure that this is among your top priority. The sooner you get it done, the less stressful it will be during the deadline.

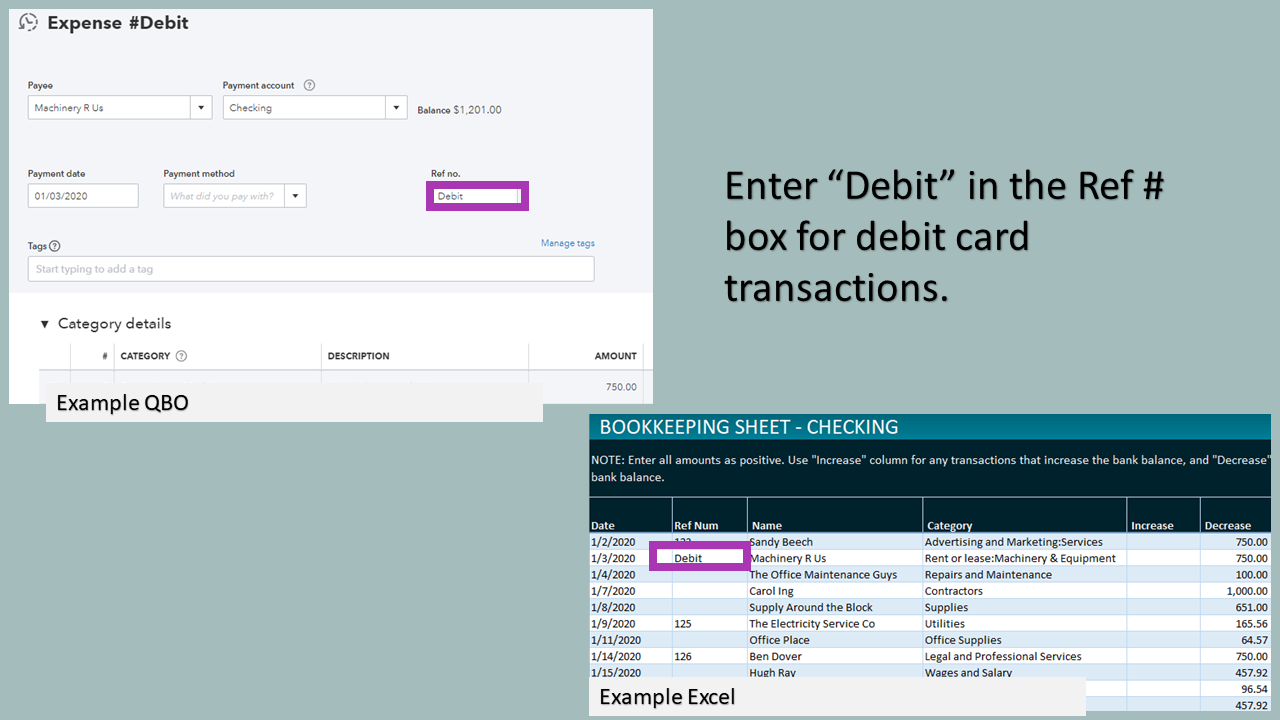

#3 – Mark off debit card transactions

When filing 1099s, we don’t include amounts paid with card, including debit card. This is because these payments are processed differently, so the payment processors actually file the 1099s for these amounts (for more info, check out this article). The problem is, that unlike a credit card, when we use a debit card to pay, the amounts are directly withdrawn from our bank account. Which means, the debit card transactions get mixed in with all our other bank transactions, making it more complicated when trying to figure out what amounts we actually need to report on 1099s.

That’s why we need to mark off debit card transactions to be able to separate them from the other bank transactions. And the best way to do that when you’re recording these transactions is to write the word “Debit” in the reference number line

When you do that in Quickbooks, the accounting system will automatically know not to track these amounts for 1099. When you do it in a spreadsheet like Excel, you can filter out these transactions when you calculate 1099 amounts.

An Excel bookkeeping workbook that tracks 1099 transactions?

With my “Excel Accounting System for Schedule C Filers” workbook, you will be able to automatically track 1099 payments and exclude the amounts to vendors that don’t qualify for 1099s (e.g., debit transactions). For more info, check out this link.

#4 – Consider e-filing

If there is one thing that makes life so much easier in January, it’s e-filing 1099s. Like, I cannot even express how life altering it is. Here’s what I love about it:

- It’s way faster than paper filing. You’ll have to prepare up to four copies of each form that you file (one to the IRS, one to the state if required, one to your payee for his/her records, one to your payee for his/her filing purposes). Having to fill out the exact same information 4 times for EACH form you have to file? I’m nauseated just thinking about it. Sure, you can buy copy forms, but that just means a mistake on one is a mistake on all. (I don’t even want to tell you how many carbon copies I’ve wasted). With e-filing, you don’t have to worry about filling out multiple copies of the same form; you enter it once, and all the copies get completed. Need to update the information? Do that once, and they all get updated. Time saver, much?

- You’re less prone to penalty-inducing mistakes. There are countless formatting requirements that come with filing 1099s; lots of things you need to do, and a whole lot more you shouldn’t do. If you’ve read my article on the common 1099 filing mistakes, you might remember I’ve mentioned a couple of these (e.g., using special characters). With e-filing, you’re much more likely to have everything formatted correctly because the e-filing program does all of that for you. So you don’t have to remember things like, don’t add any commas when reporting amounts over $1,000. Not at all the same story for paper filing. Plus, you’re also less likely to make clerical errors and typos because there’s less manual entries required (I mean, it’s still possible to make errors, but the risk is so much lower than if you manually filled out paper forms).

There is a fee to filing 1099s electronically (typically, a few dollars per payee). But for the benefits that you get, I say it’s worth it. Plus, you get to write it off as a business deduction. One of my favorite 1099 filing software programs is Tax1099.com

If you use any of these tips, you’re well on your way to a stress-free 1099 filing season!