What is Undeposited Funds in Quickbooks Online?

If you record payments from customers using the Receive Payment or the Sales Receipt forms, there’s no doubt that you notice that the default “Deposit to” account is Undeposited Funds. It’s seems a little counterintuitive to record payments as being deposited to an undeposited funds account, so why is this the default account? Should you change it to your actual bank account? What’s the deal? Let’s look a little closer at the Undeposited Funds account in detail.

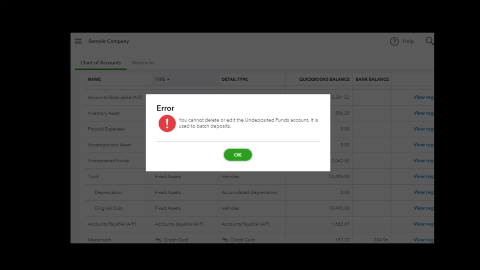

First off, the Undeposited Funds account is an account created by Quickbooks, and there’s no getting of it. You can try to delete it (and maybe you have), but the system won’t let you.

But why? What purpose does the account actually serve that your checking account can’t handle? Here’s the deal. You collect payments from customers; then you deposit the payments to your checking account – but usually not right away. The time and space between the payment collection and the payment deposit – that’s what the Undeposited Funds is accounting for. Many people don’t deposit a payment as soon as they receive it. They hold on to it for some time (even if it’s just for a few hours). Undeposited Funds, at its core, a holding account, representing the step in between receipt and deposit.

- Collect payments from customers (record customer payment)

- Hold on to payments until ready to deposit (customer payment is recorded as “deposited to” Undeposited Funds)

- Deposit payments (record deposit by selecting the deposited payments that were previously held in Undeposited Funds)

But is it really necessary to have an Undeposited Funds account? You might hold on to payments before depositing them, but do you need to record that you’re holding on to it? Surely, it’s easier to just record the payments directly as a deposit to the bank account, since that’s where it’s ultimately going anyway? Technically, you could. But the ramifications could be catastrophic. CATASTROPHIC I SAY!

It’s usually okay to record the customer payment as being deposit directly to the bank account IF you only deposit one customer payment at a time. That’s because recording the payment directly to the bank account will record that payment as an individual bank transaction. However, it’s usually the case that people bundle multiple payments together into a single deposit. If that’s the case for you, and you record payments directly to the bank account rather than via the Undeposited Funds account, it’s going to be more difficult to match those payments to the deposit in the bank feed (Quickbooks will be less likely to suggest an appropriate match), and it’s also going to be more difficult to reconcile (even if you match the deposit, there’s a good chance you’ll still have to manually track and check off the individual payments in the reconciliation window). It will also be near impossible to search for or reference the bank deposit in the future since the deposit is technically recorded as multiple individual transactions. So yes, using the Undeposited Funds account may seem like a negligible step, but it is actually a pretty crucial step to making sure everything is properly recorded and the financial data in your books is reliable to use.