Maximize your biz tax write offs

Maximize your biz tax write offs

You put a lot of sweat (maybe even a few tears) into building it up and growing your business.

So just handing over most of your hard-earned profits to Uncle Sam? Not exactly not you had in mind.

Not when it could instead be put back into your business. Or invested in your financial future.

But one of the many awesome things about being a biz owner–the tax law is on your side. Which means that there’s an abundance of tax deductions available to you that can significantly reduce your tax bill.

You just have to know what they are and how to use them to your advantage…

For more than a decade, I’ve helped small biz owners like you make the most of their business deductions and save thousands each year.

Now, I’m sharing my tax savvy and insights with you.

In this course for self-employed, service-based biz owners, we’ll go through the biggest tax-saving deductions you’re rightfully entitled to take, so that you can *legally* slash your tax bill.

We’ll also look at how to claim them correctly, so you can stay out of trouble and on the good side of the IRS while you’re at it.

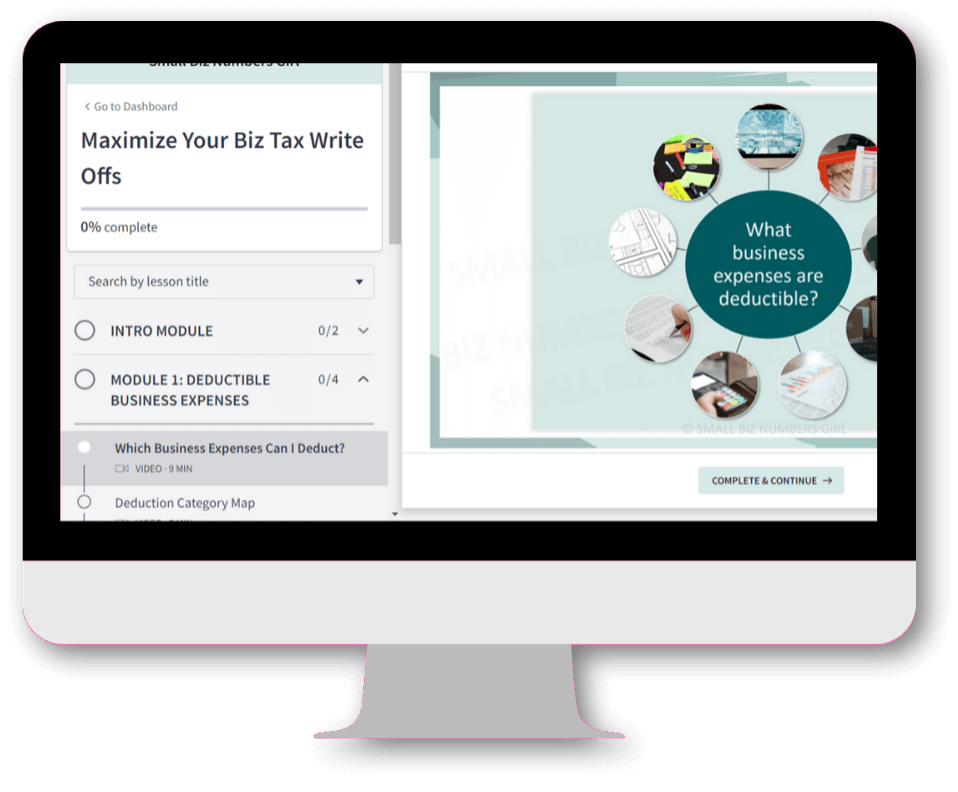

Course curriculum

Course curriculum

Deductible Business Expenses

Learn the exact criteria for determining which business costs you can write off, so you can keep more of your profit in your business.

Special Biz Deductions

We’ll break down the more complex business deductions so you can write them off with confidence.

What NOT to Deduct

Not all biz items are “write-offable”. We’ll uncover the most common things you’ll want to avoid deducting, so you can keep yourself out of trouble.

Turning Everyday Expenses Into Tax Savings

Most people can’t deduct personal expenses. But you’re not most people. Discover how you can turn some of your personal things you use in everyday life into legitimate business tax write-offs.

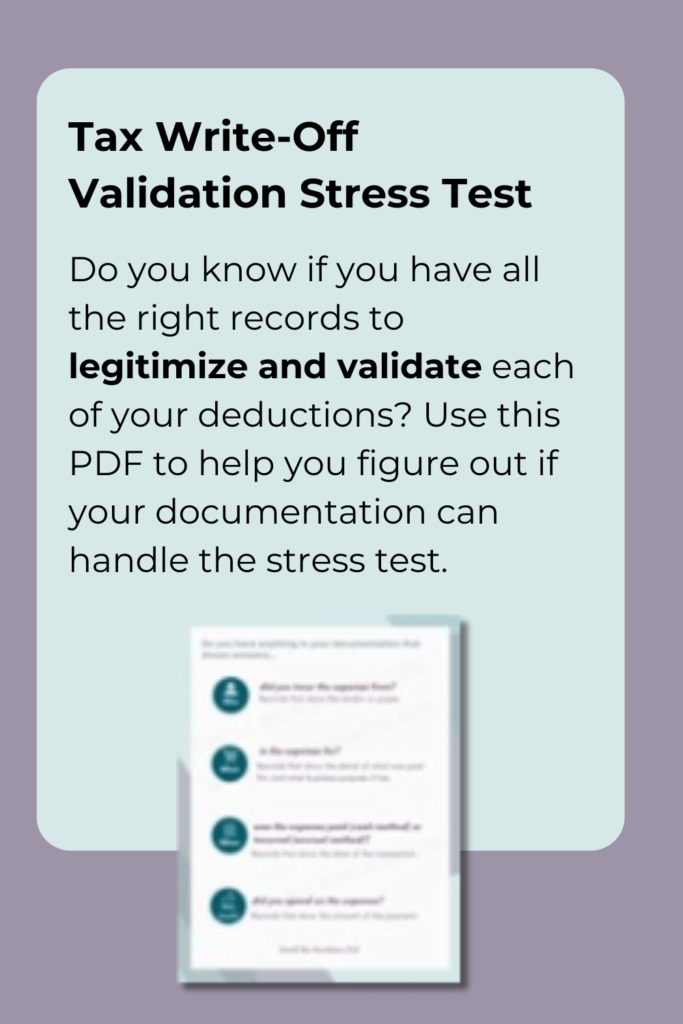

"Audit Proof" Your Deductions

Learn the costly—yet all too common—mistakes to steer clear of so you can reduce your risk and avoid overpaying taxes.

Jam-Packed With Awesomeness...

Jam-Packed With Awesomeness...

Self-paced video lessons

Bite-sized, easy-to-follow videos you can watch on your own time.

Gigantic List of Deductible Business Expenses

A comprehensive PDF collection of the biggest business expenses to include in your own write offs so you can slash your tax bill.

Slash Your Taxes Game Plan

Use this PDF workbook to guide you through the initial and ongoing tasks to skyrocket your tax savings year after year.

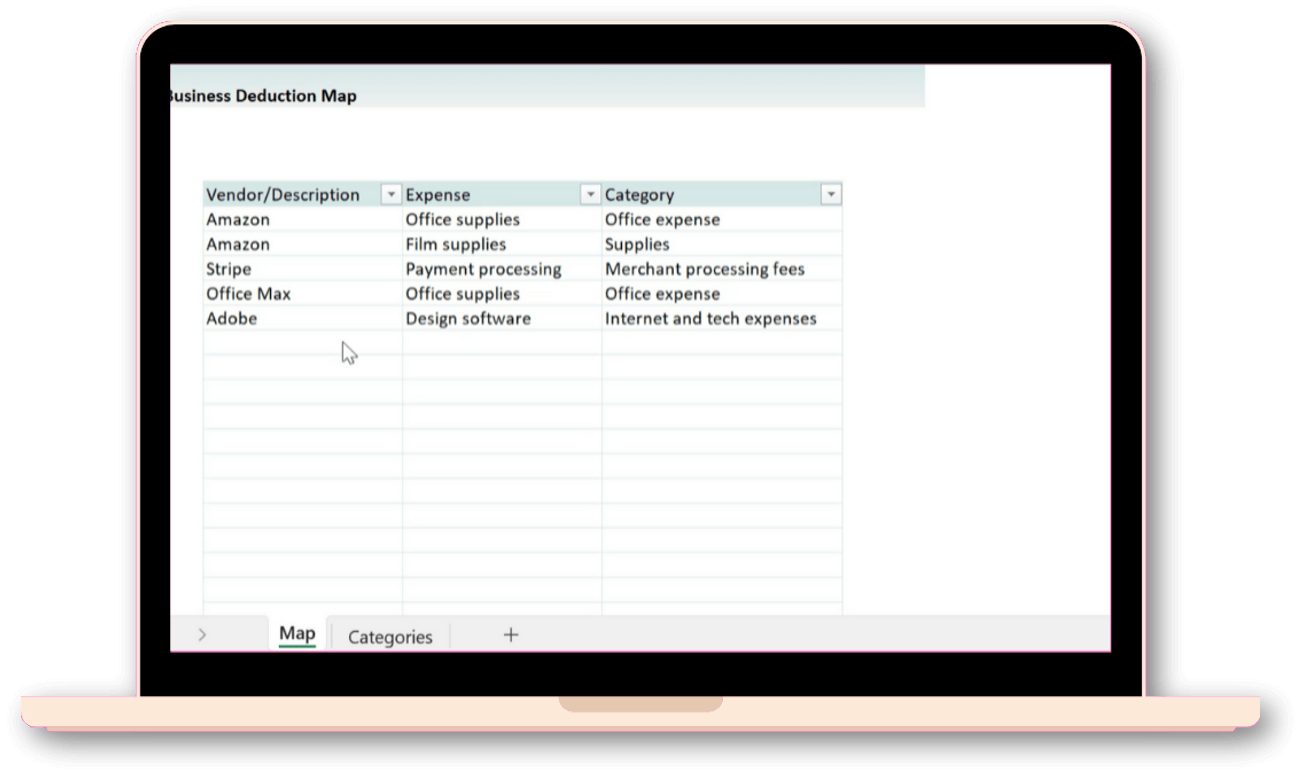

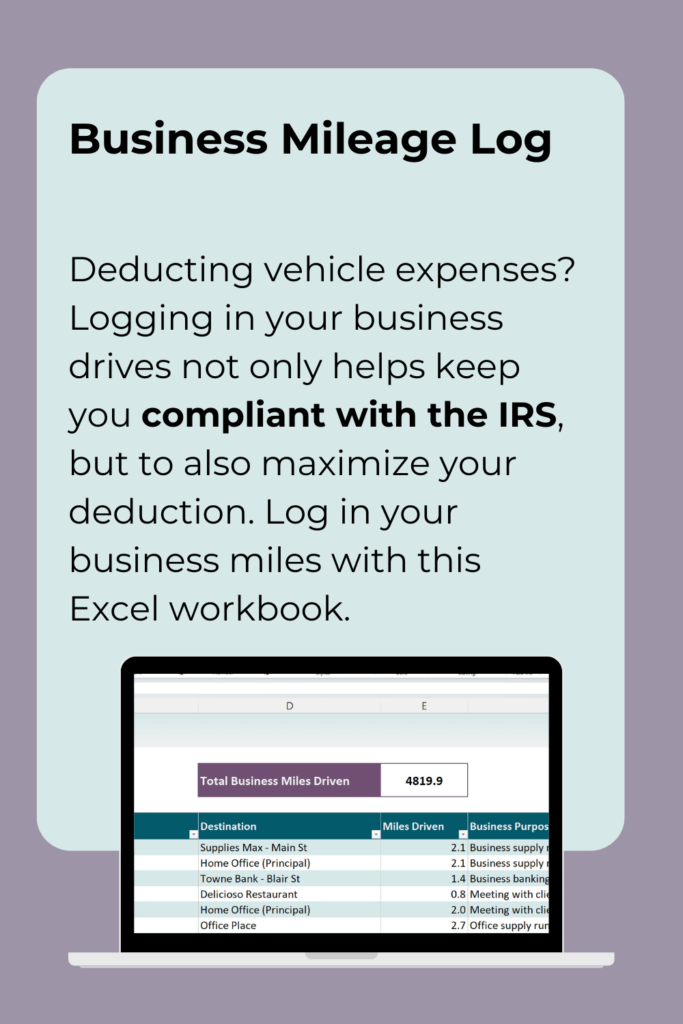

Business Deduction Category Map

Use this Excel workbook to help you properly categorize your deductible biz expenses and avoid “red flags” on your tax return.

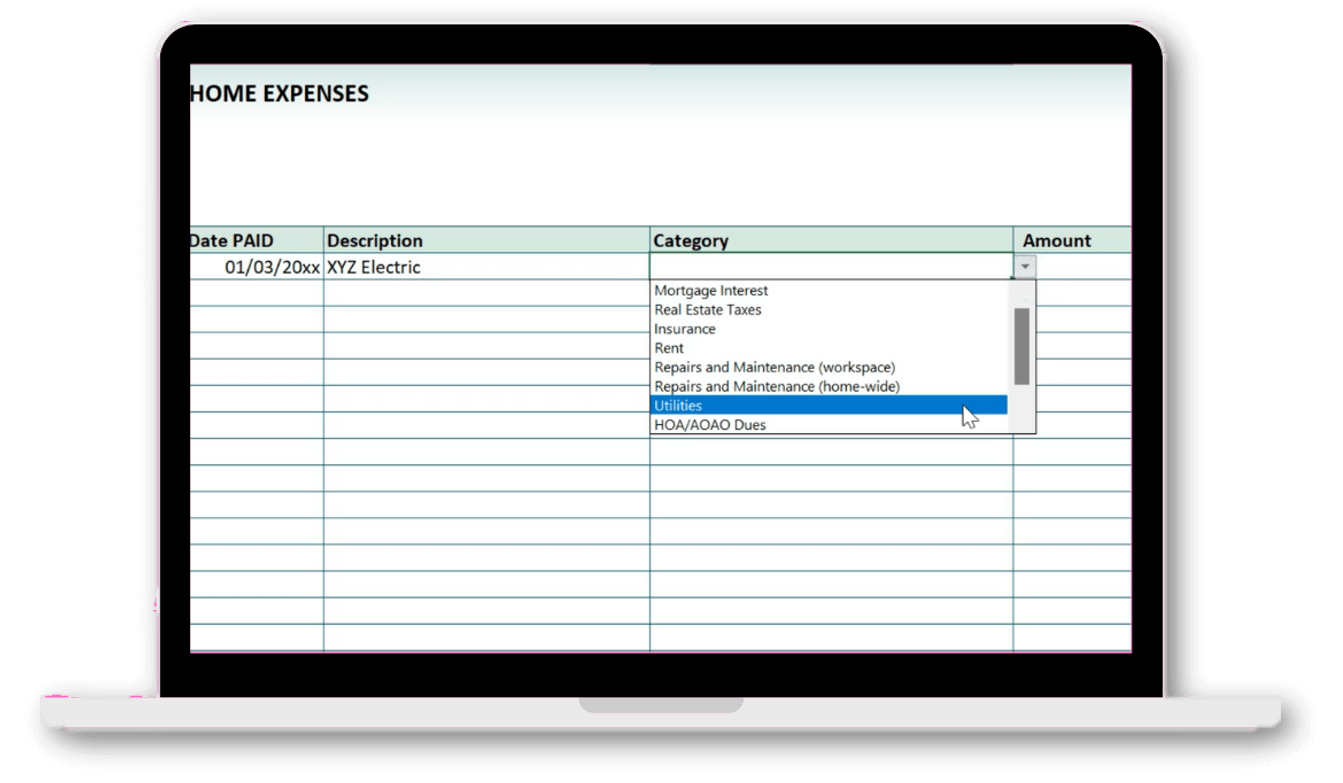

Deductible Personal Expenses Tracker

Use this Excel workbook to maximize the personal expenses that can be converted to business deductions each year.

Plus bonus lessons and materials…

Full price: $297

Early bird offer: $47 (tax deductible)

What's the early bird offer?

We already put a ton of value into this course. Buuut…it’s still a work in progress–our goal is for you to get the most value out of it.

So before we officially release it, we’re opening it up to a limited number of biz owners first. If you were to snag one of those spots, you would be offered the early bird price at checkout.

From there, you would get instant access to the course, which you can go through at your own pace. And if you were to have any feedback or questions along the way, you can drop it right into the course itself.

With your helpful feedback and collab, we can make this an even more valuable resource for you.

If that sounds good to you, grab your spot while there’s still room…

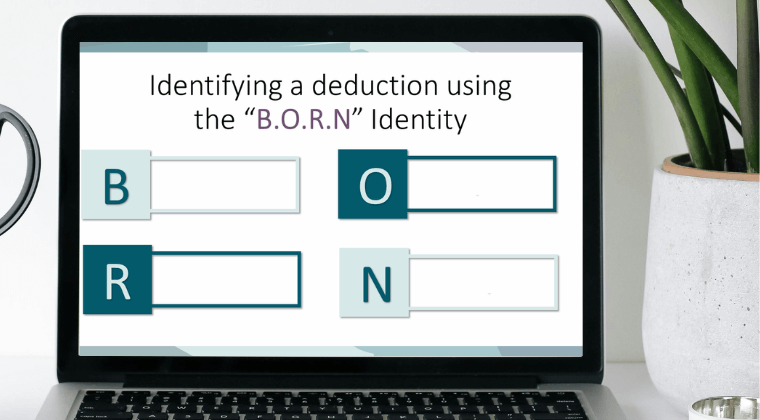

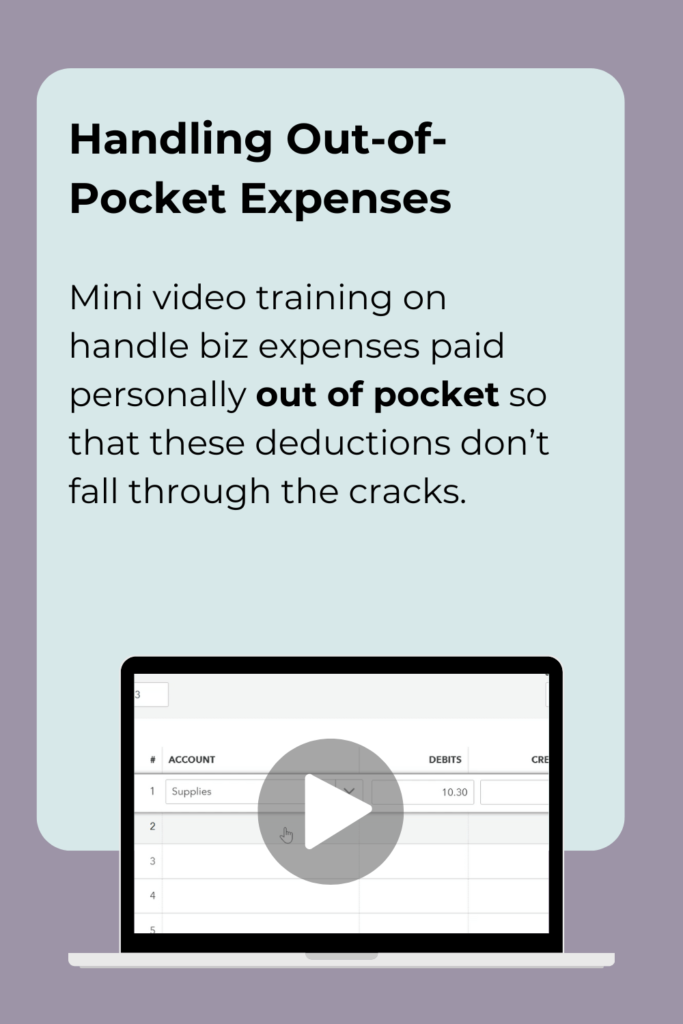

Take a sneak peek...

Who Will Benefit Most From This Crash Course?

Who Will Benefit Most From This Crash Course?

This is for you if:

This is NOT for you if:

❌Your business is a partnership or has special tax treatment (S corporation, C corporation)

❌You are not a cash-basis taxpayer (cash basis means you pay taxes based on sales collected minus expenses paid. Most service-based and digital product-based small biz owners use cash method for taxes.)

❌You and/or your business are not based in the U.S.

Frequently Asked Questions

This is an online-based masterclass, so all you really need is a computer and internet access to view the course.

I’ve also included “plug-and-play” Excel workbooks. You’ll need Microsoft Office for these to function properly.

After you checkout, you will be prompted to create an email. From there, you will be taken directly inside the masterclass. You can bookmark the page. You’ll also get an email for the link to the course. Login anytime with your email and password.

The masterclass is on-demand, so you’ll have instant access and go at your own pace.

You will have access for the entire lifetime of the course and supplementary materials (including all updates).

You will be able to download the Excel workbooks and PDFs for your personal use.

The course is roughly 2.5-3 hours total.

And remember, you can go at your own pace. Think of this course as a resource that you can refer back to when you need it.

You’re why I do what I do…

So here I was, in public accounting with grand ambitions. On my way up the corporate ladder. When something stopped me in my tracks.

You.

Well, small business owners like you. During my time in public accounting, I got to work a wide range of clients. But it was the small biz owners that made the job worthwhile. The passion-filled, hard-working, (slightly crazy) risk-takers who dared to go against the grain, and turn a dream into something real. To create and build something wonderful, to call their own. And being able to be a part of that with them? There aren’t words to describe the feeling.

So 10 years, 1 CPA license, thousands of tax returns & financial statements, and twice as much cups of coffee later…and I’m still blessed to get to partner with small biz owners like you on their business journey. To use my skills and experience to help them build a sustainable, profitable, yet passion-driven business. And of course, plan and save on taxes along the way.

And hopefully, this course will be my opportunity to join and help you on even this small part of your biz journey. What do you think? You in?

Ya’ Numbers Girl,

Vee

DISCLAIMER: Use of this product does not guarantee accuracy, desired results, or avoidance of penalties. The product, or any other content and information provided does not constitute legal, financial, tax, or any professional advice. It does not constitute a professional-client relationship. Consult with your professional.